Opportunities break down

There is a specific situation at point 2, as it is not a bounce that has occurred, but a break of the original support, which has now become the new resistance. Situations like this happen and no one knows in advance when a given area will be respected and when a breakout will occur. Therefore, you don't want to enter trades blindly, you need some confirmation to indicate that the price might move in the expected direction. For this, candle formations from the H4 or H1 chart can help.

Confirmation of opportunities using Pin bar

If you are not familiar with what a pin bar formation looks like, the image below will show you.

Pin bar formation characteristics

-

The opening and closing of a candle on which we suspect a Pin bar must take place "inside" the previous candle

-

The pin bar candle must be unusually long and protrude above the surrounding candles (especially the wick)

- The ideal Pin bar closes near the low/ high of the previous candle

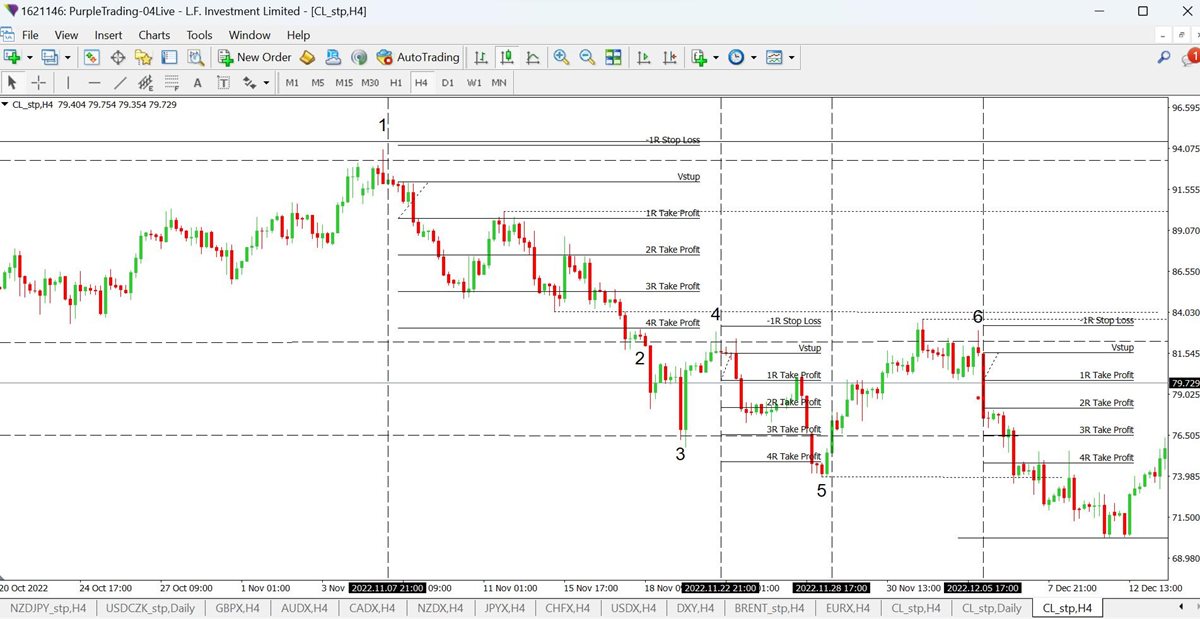

We will look for confirmation of the Pin bar opportunities identified above first on the H4 chart. This is shown in chart 3. Supports and resistances from the daily and weekly charts are still shown and in addition, some supports and resistances that can be seen on the H4 chart are plotted in dotted lines:

WTI crude oil on H4 chart with potential entries plotted

WTI crude oil on H4 chart with potential entries plotted

The procedure is that once the price touches key support or resistance that we have identified on the weekly or daily chart, we wait for a reaction at that area and enter after the confirmation in a form of a Pin bar.

Opportunities confirmed - what now?

For the previously mentioned opportunities, we created three situations in which the entry was confirmed by the Pin bar. We place the stop loss above the Pin bar for the short speculation and below the Pin bar for the long speculation. Take profit is then placed to the nearest support for short speculation and near the resistance level for long speculation. Since these are swing trades that last for a longer period of time, we define these target areas by the daily chart (dashed line) or the weekly chart (solid line), whichever is closer.

In the case of the trade in point 1, the risk/reward ratio would be 1:4. For the trade in point 4, the risk/reward ratio would be 1:3 and the same ratio would be for the trade in point 6. If the risk unit is 1%, then the return would be 10% for the period from 7/11/2022 to 7/12/2022.

Waiting for market entry is worth it

Why wouldn't we trade at point 2 in the long direction the moment the price touched key support? Because at this point there was no Pin bar or other reversal candle formation. This shows how important it is for the identified zone to wait until somehow the reversal of the price movement is confirmed. If we had not waited, a loss would have been inevitable in this case.

And why didn't we consider the trades in points 3 and 5? At point 3, although a Pin bar did not arise, confirmation arose with a strong bullish candle, called an engulfment. This would have been fine, however, this trade would have had a disadvantageous risk/reward ratio after entering the next candle if we had directed the profit to the nearest resistance according to the D1 chart.

The trade at point 5 is a specific situation in which support was broken first, but the price then returned above that support. It was therefore a false breakout. While false breakouts tend to be quite strong opportunities and in this case, it would be worth trading it on a risk/reward basis, this is a very specific area that deserves a chapter of its own. Therefore, we will discuss trading false breakouts in more detail in a future article.