Smart Money - liquidity inducement

In the context of liquidity collection, the term inducement is used, which means "lure" or "trap".

From the examples above, you may have guessed what this is all about. When the market creates a readable situation, such as resistance, the trader thinks the price will turn there and enters the trade short, putting the stop loss above the resistance.

Often, however, he will do this too soon under the fear that he might miss the opportunity (technically known as FOMO (Fear of Missing Out). Price manipulation at these levels can also contribute to FOMO - for example, the price starts to make small pullbacks, so the trader gets the belief that the move will happen...etc. This trap will then attract other traders. Once enough orders accumulate above resistance, those will be picked first and then the real move will begin.

Inducement is therefore a situation that will give the impression that the price will move in a certain direction. Once enough orders (which are liquidity) have been lured in, they will first be picked. Only after this manipulation will the actual movement occur.

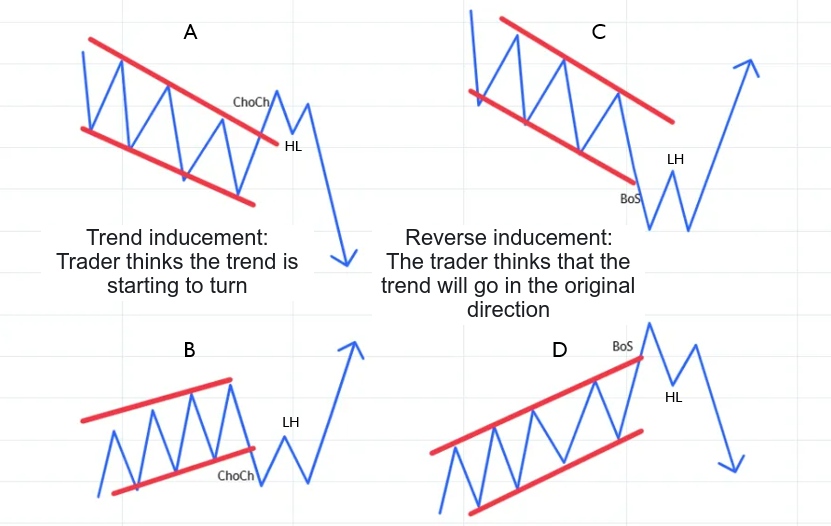

The following diagrams show us examples of different traps:

Examples of "inducements"

Inducements can arise in different trends and at different price points

The basic types are shown in Figure above:

- Situations A and B are examples of situations where the trader thinks the trend is starting to turn, but after manipulation, the market continues in its original direction.

- Situation A shows a clear downtrend. As soon as the last lower high is broken so that the first higher high is formed, the trader starts to think that a trend reversal (Change of Character) is occurring and starts to speculate long. However, the stop losses that he places below the first higher low (marked as "HL") serve as liquidity that the market will start to collect, and therefore the price will start to fall in the direction of the main trend.

- Situation B shows an uptrend, when the first lower low is formed the trader starts to think that a change in trend is occurring, so he enters short, placing the stop loss above the lower high (marked as "LH"). This is then selected and the trend continues upwards in the original direction.

- In situations C and D, a situation will arise where the trader is convinced that the trend is continuing in the original direction, only for the market to turn in the opposite direction.

- In situation C, a BOS (break of structure) occurs in the downtrend and a new lower low is formed. This convinces the trader that the downtrend is gaining momentum. When a new lower high is formed. traders place stop losses above this lower high (LH). After liquidity is collected the price continues upwards.

- In the case of situation D, this is analogous to an uptrend. Once the BOS occurs and a higher high is formed, the trader is confident that the uptrend will continue. He puts the stop loss below the new higher low (HL). These orders are then selected and the market reverses.

- The above examples suggest that levels or patterns that indicate where liquidity withdrawals will occur tend to be more complex than mere false breaks on horizontal S-R zones. But if you start to look at the market through this lens, you will gradually gain experience that will open up a new dimension of trading.

How to trade liquidity

-

On a higher frame - weekly, daily or H4, mark the main price levels and identify what trend is taking place (uptrend, downtrend, sideways).

-

Since you now know that liquidity trading works by having the price sort of overshoot a given level, unlike the traditional plotting of supports and resistances, which tend to be shown as certain zones of a certain range, in the case of this concept, you just need to plot a simple line that comes from the highest point (in the case of resistance) or the lowest point (in the case of support).

-

Then wait for the price to jump over that level. This is a signal that the market is picking up liquidity beyond that level.

-

The next step is that the price must go back down (below the resistance line or above the support line). This will indicate that liquidity has been selected. This pullback must be valid, i.e. the candle should close in that area. This close in that zone should be clearly visible (see charts 5 and 6).

-

To enter, wait for confirmation on a lower timeframe (e.g. Price Value Gap, engulf, pin bar, etc.).

-

Since the liquidity withdrawal has already occurred, a tighter stop loss can be given which will then allow for a more favorable RRR. This is the main advantage of the whole concept.

Example:

In the picture we have the AUDCAD pair on the weekly chart. At point A a high has been formed, at point C a low. At these points, we then draw a line that will mark the liquidity selection limit. We then wait for the price to "cross" these boundaries. The "overshoot" occurred at points B and D.

AUDCAD on the weekly chart

We then move to a lower timeframe, in this case D1, where we wait for a form of entry confirmation. In the case of the speculation at point B, it looked like this:

Price picked up liquidity through candle #1, and during the same day it came back below this resistance, where this candle also closed. This close below the resistance level is distinct, clearly visible, and easily identifiable, so it is valid (it would be invalid if the price closed above resistance, at resistance, or just slightly below resistance, which would not be distinctly clear).

Candle 1 also resembles a pin bar, which is a reversal formation. Entering at the next candle (indicated by the arrow) and with a stop loss above the high of the formation and speculating to the nearest support, a trade would be created with an RRR of 1:5.

AUDCAD on D1 chart, speculation short

The next chart shows an analogous situation, this time in reverse.

AUDCAD on D1 chart, speculation long

At point D, the price broke through support. After liquidity withdrawn, a bullish engulf was formed (candle 1) and the price closed above the support. Again, we can see that the close above support is significant, it is clearly visible and easily identifiable. This is a strong signal. Entering on the next candle and with a stop loss below the lowest price of the formation, an RRR of 1:3.5 would be formed to the nearest major top