Brent and WTI price difference

Physical discrepancies in crude oil specifications and short-term swings in supply and demand have historically driven price variances between Brent and WTI oil. For example, before September 2010, there was a standard price gap between WTI and Brent of about 3 USD/bbl; however, Brent has been priced substantially higher than WTI since the autumn of 2010, hitting a spread of more than 11 USD a barrel by the end of February 2011.

However, the spread usually fluctuates and is heavily influenced by market conditions. For example, as of May 2022, the spread between those two is only 1 USD as the market has been disrupted by the military conflict between Russia and Ukraine.

Performance

Oil tends to be highly cyclical – it usually rises in periods of either high inflation, high economic growth, or both. But, on the other hand, it tends to underperform when the global economy is heading into a recession.

Oil had a big runup in 2007 – 2008 as it jumped from 40 to 140 USD, helping to cause a global recession. It then quickly declined back to 40 USD as demand waned due to economic problems worldwide. However, as the global situation improved, demand returned and it managed to get back toward 120 USD. It then oscillated in the 100 – 40 USD area.

During the panic of 2020 after the world’s first COVID lockdown, Brent oil fell toward 0 USD, only to recover massively as central banks started printing money and people managed to return to normal lives, boosting demand.

n 2022, oil jumped toward 140 USD as Russia invaded Ukraine, prompting supply issues mainly in Europe. Brent oil has shown some great returns for long-term investors with a strategy of proper timing of exiting. However, its volatility is also perfect for short-term and swing traders.

Brent oil - quotes and trading

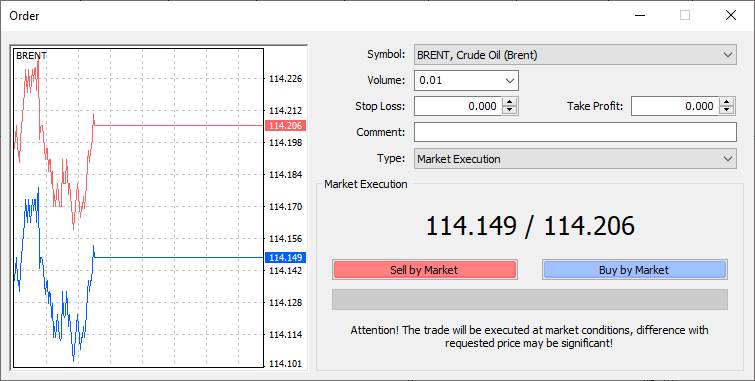

-Brent oil CFDs may be traded on our Purple Trading Metatrader 4 platform. To begin, locate the ticker BRENT in the Metatrader 4 platform and press the new order button. The following window will popup:

Source: Purple Trading Metatrader 4

Source: Purple Trading Metatrader 4

Lot value calculation

When you open our Metatrader 4 platform and click on the BRENT ticker, you'll observe that during moments of strong liquidity, the difference between the Ask and Bid price is roughly 6.00 cents (usually when London and New York are open for trading).

The minimal volume for trading Brent oil is one micro lot (0.01). If you trade a mini lot (0.1), you will gain or lose 10 USD for each 10 cents oil makes. When trading half a lot, each 10 cents of oil movement will yield 50 USD of profit/loss. For example, you buy half a lot at 115 USD, and oil goes to 116 USD. Your total profit will be 500 USD (calculated as 1 USD (100 cents) movement * 50 USD profit per 10 cents of the move). The same logic applies to calculating your profit or loss when entering a short position.

Keep in mind that Brent oil is quoted in US dollars, therefore if your account is in EUR or another currency, your profit or loss must be converted to EUR at the current exchange rate.

You can trade at the current market price (market execution) or utilize pending orders, (limit and stop orders). You can initiate the trade without the stop-loss and take-profit orders now and add them afterwards.