Bitcoin remains high as the market changes

A similar sale does not yet accompany the rise in the price of Bitcoin to $ 40,000 as in 2017 and it will probably never will. An external shock would have to come, but the central banks are delaying their monetary policy. At the same time, the market has changed a lot since 2017, and cryptocurrencies are no longer just bought by tech geeks, anarchists, and libertarians. Self-confidence remains high, but can Bitcoin continue to grow, or will it find a new "fair" price?

Liquidity from central banks

The ongoing rally on Bitcoin seems to be supported mainly by the monetary policy of central banks and the growing interest among institutional investors. There’s probably not much else to which we could coin this growth to. Bitcoin is a large enough market to withstand short-term profit-taking from smaller investors, such as the /wallstreetbets community. Central banks and their vast amounts of liquidity, which have been pumped into the system, have found their way into different asset classes, thus supporting the growth of their prices. The hunt for income does not avoid even more alternative investments. However, the situation has changed a lot since 2017. At the very beginning of the growing trend in 2012, geeks and enthusiasts were behind the cryptocurrency movement. This profile has changed completely since then. Outside the institution, Bitcoin is held by a large proportion of investors who do not have this asset solely for profit, but for example like the concept of digital gold, where they hedge against the collapse of the entire monetary system, rising inflation or simply bet on its future.

Skeptics are on the decline

There is still plenty of skeptics, but they are gradually declining. They are mainly afraid of a sharp rise in prices and perhaps rightly so. The market is largely on a wave of sentiment and is highly speculative, which attracts retail investors, for whom it is very easy to buy Bitcoin as well as buy Gamestop or AMC shares. However, the traditional financial community, which has long avoided Bitcoin, has also begun to cover the market over the past two years. Among other things, there are other ways to invest in Bitcoin. The Grayscale Bitcoin Trust allows investors to trade shares in trust funds that hold Bitcoins, and each share is priced very close to the price of Bitcoin. Grayscale flowed $ 5.7 billion in 2020, four times the total capital that it flowed between 2013 and 2019.

Graph: Annual inflow of money into Grayscale (Source: FT.com)

Growth or side movement?

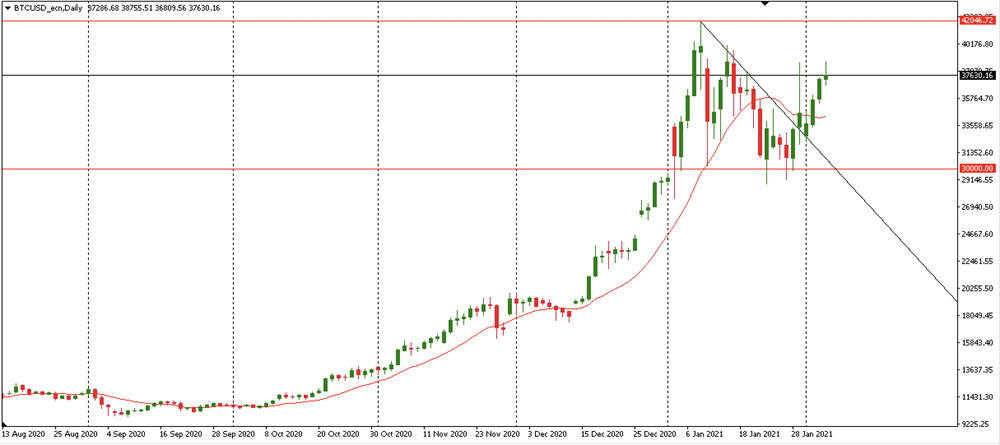

Further development of Bitcoin is pure speculation for most investors. Its development is not so much based on a solid foundation, but as it was said, it is more about sentiment. However, this does not mean that its price must fall. A few thousand dollar decrease that took place after the attack of $ 40,000 was nothing more than a healthy technical correction. There will most likely not be a huge collection of profits, at least not unless the central banks unexpectedly change their course by 180 degrees. With its capitalization, the market has already reached one-fifth of the total gold held for investment and trading. It is certainly not an asset on which would be worth betting entire investment capital. Over time, however, it will be missed in every investor's portfolio. Similar to the increase in 2017, but we can expect a period when the price will find its "fair level", around which it can move for several months. Maybe something similar is starting right now.

Chart: BTCUSD Daily Chart (Source: PurpleTrading cTrader)