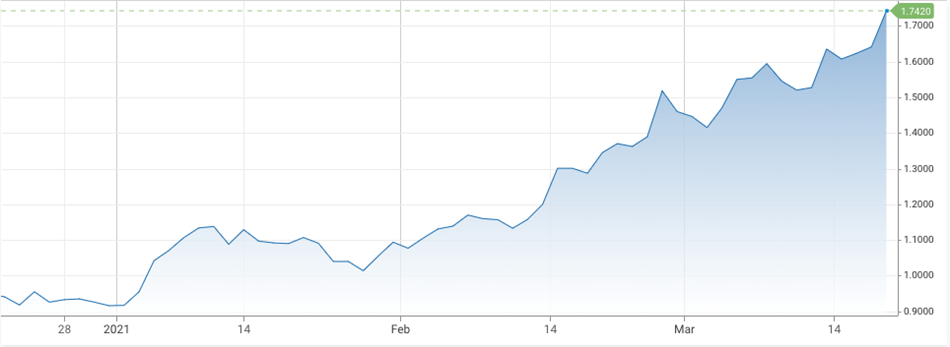

FED did not calm down the bond market, 10-year yield attacks 1.75%

Yesterday's FED meeting was mainly about the bank's economic projections regarding economic growth and further inflation. However, many investors were impatiently waiting for how and/or if the bank would comment on the growth of government bond yields at all. The prevailing consensus was that bankers would try to push the yield lower, but that did not happen, and the ten-year yield today may be attacking an "alarming" 1.75%.

Yield as a triggerfinger for greater correction

How high must the yield on ten-year bonds rise to cause a more pronounced correction in the stock markets? We asked similar questions a month ago when higher yields were becoming a problem and technology stocks have not been able to find solid ground since then. According to Goldman Sachs, a month-on-month change of 0.36% will be enough to make the shares more nervous. The majority consensus was that a problem for markets could arise when yields reached 1.75%.

Chart: Development of ten-year revenue in the USA (source: cnbc.com)

The FED did not calm the market

Currently, the yield on ten-year maturities is 1.74% and has increased by 0.33% since the beginning of the month. Over the last 30 days, it has grown by 0.44%. The pace of growth is certainly not slowing down yet, and what is more alarming is the FED's inability to moderate investors' fears and try to squeeze yields. There was no meaningful answer to the question of market intervention and possible control of the yield curve. Powell just reiterated that good macro data is still ahead of us. However, if the FED does not either increase bond purchases or adjust the quantitative easing program, yields show that they will continue to grow.

The FED thus left the bond market free to enter the danger zone. The bank may fear that further purchases would overstimulate the economy, which over time could show signs of overheating. So far, the beginning of today's session suggests that nervousness is far from over and yields above 1.75% may push up growth stocks again, which benefit from low borrowing costs, and many investors may also begin to move back to bonds that offer interesting yields. Rotation into valuable and cyclical stocks can also be accelerated.

Chart: Nasdaq Daily Chart (source: PT cTrader)