Is gold “mining” for its bottom?

Gold has lost almost 9% of its original value since the beginning of the year, and its price is under pressure despite the still uncertain situation regarding the pace of vaccination, continuing monetary and fiscal stimulus, and rising inflation expectations. The correction on the stock markets did not help it to grow either. Why is gold still falling and where could it find its bottom?

A supercycle that missed gold

While most industrial commodities have been rising to new highs in recent weeks, gold is still losing and slowly disappearing from the investors’ radar. In the commodity market, there has been talk of a "supercycle" in recent weeks, where, according to many analysts, growth in commodity prices is still in its infancy and the expected economic recovery should ensure steadily growing demand. Many economies in Europe, meanwhile, are still struggling with an increase in new cases of coronavirus, and growth in demand for some commodities from these countries will intensify during the year.

Safe but with no yield

However, this is not the case with some precious metals, especially gold. Silver is more of an industrial metal, which the economic recovery will certainly help and its price may still rise, but gold has deepened its losses in recent weeks and has been 9% cheaper since the beginning of the year. As last week showed, gold will probably not be helped by greater nervousness in the financial markets, at least not if rising government bond yields are behind the correction. Rising yields are convincing even the last investors who are holding gold to exchange a "safe" commodity for still safe government bonds, which at least offer some regular yields, while with gold you are just waiting for the price to rise. The stronger US dollar has also been preventing this since the beginning of the year. As it turns out, gold is not helped much by investors' expectations that the US Senate will approve another fiscal package, or that the Australian Central Bank will increase bond purchases and neither by continued monetary stimuli around the world. All this is has been already taken into account in market’s development.

Will gold start looking for its bottom?

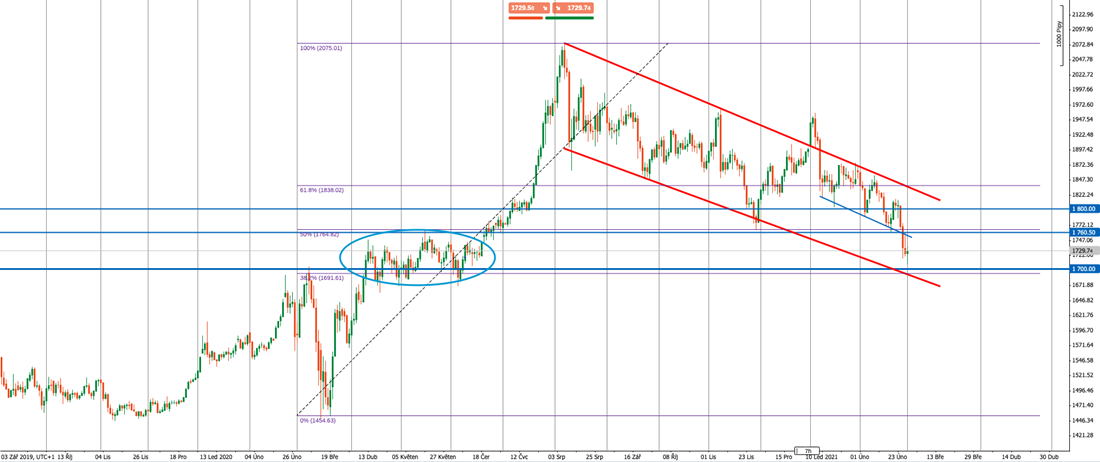

Although some might have written off gold several times and its weakening is no surprise for them, we are entering a phase where it is possible to look in the market for signs of whether is gold looking for its bottom or not. The current price of gold and its fall so far suggest that the market should now begin its "resting phase" and consolidate around the level of $ 1,700, which is also 38.2% of the last swing. This is indicated not only by the dynamics of the current decline but also by the technical analysis. That’s because the market is about to enter the area of previous consolidation (circled in blue) and it is here that the market will match the orders effortlessly. At the same time, gold is now extremely bearish, which historically foreshadowed the approaching bottom. The question now remains whether this will be the bottom that the market will break through as the downward trend continues, or whether the market will start to turn around and erase losses.

Chart: Daily gold chart (source: purpletrading cTrader)

Stimuli and inflation

From a fundamental point of view, gold could start to grow in the second half of this year. This is indicated by inflation expectations, which have been in the United States the highest since 2014, but also seasonality, as gold usually grows the most in August and September. However, inflation expectations alone are not enough, and prices must really start to rise in the economy. Hard data should point to something similar in a few months. Bond markets are also worried about inflation, with yields rising the most in the last year. However, higher bond yields may slow gold growth for the reasons mentioned above. Vertical growth on digital gold and the potential end of the growth cycle on crypto may force many investors to move their assets back to traditional gold.

The positive mood in the markets and in the economy will probably not help gold. However, what might help is the US dollar, which should weaken further this year, but is now at extremely low levels, so its influence will not play such a role. Gold has not yet found its bottom and will first begin to consolidate. Accumulating orders will tighten the “spring” on the market, which will not spring until the foundation itself tells where the gold will go. If really strong monetary and fiscal stimuli deliver faster inflation, gold could approach $ 2,000 again. For now, however, we need to moderate optimism, however, further declines are also less likely.