OPEC favors a higher oil price

The long-awaited meeting of the oil cartel OPEC and its allies, including Russia, took place yesterday. The market generally expected the cartel to change its production strategy and to gradually increase production due to supply disruptions from the USA. In the end, however, OPEC preferred higher prices when it decided to keep production at current levels, therefore squeezing the market and bringing the price of oil to its highest levels this year.

OPEC cartel took markets by surprise

The OPEC+ oil cartel meeting took the market by surprise. The surprise is even more palpable in comparison to other risky assets that are not doing very well as they were under strong pressure yesterday. Even the US dollar strengthened significantly, but even that did not stop the growth of oil. The price of North Sea Brent crude rose by almost 5% and US WTI crude rose above $ 65 a barrel.

OPEC+ finally decided to continue the current production cuts in April, although most of the market expected the cartel to increase production by at least 500,000 barrels per day. The result of the meeting is, after all, the best starting point for most producers.

According to the cartel, demand is still under pressure, especially in Europe, and the economic recovery from the pandemic is still very fragile. With the ongoing pandemic being In the background, it is not so bad for producers that they can benefit from higher oil prices, which they have chosen at the expense of higher production. This could again fill storage capacity, which could put the price under pressure.

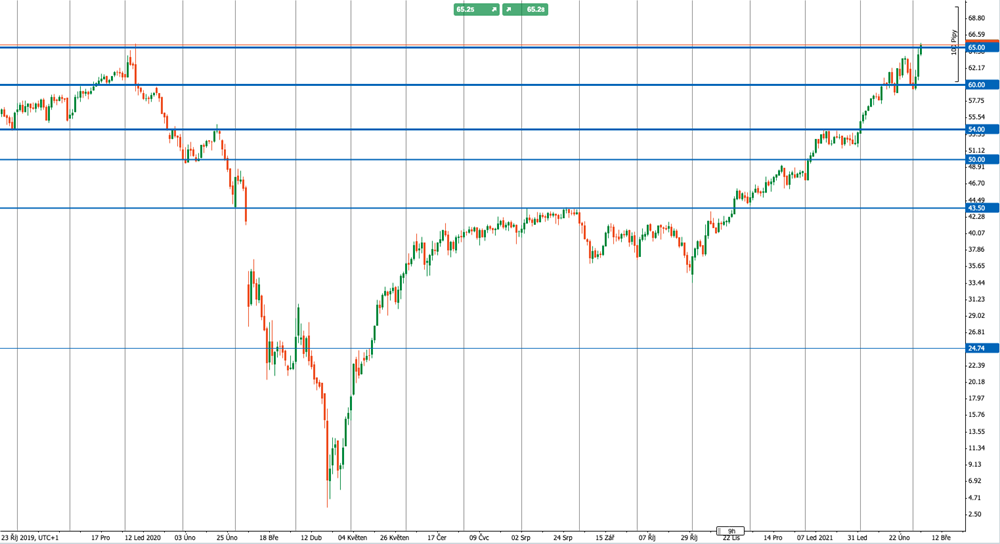

Chart: WTI Daily Oil Chart (source: cTrader Purple Trading)

Russia and Kazakhstan have been granted an exemption

The Saudis therefore deliberately cut the market and, according to their official opinion, do not see the risk of overheating. On the contrary, they want to see evidence of a strong economic recovery in order to start supplying the market more. That is why they are leaving functional and voluntary production cuts for the time being and are prolonging the additional reduction of production by 1 million barrels per day for the next month. Russia, meanwhile, received permission from the cartel to pump 113,000 more barrels a day into the market from April. Kazakhstan was also exempted with 20,000 barrels.

The willingness to sacrifice higher production at higher prices has convinced investors that there is strong imaginary support in the market that will keep the price of oil going. In the case of WTI oil, it should be $ 60 per barrel, and with gradually renewed demand, the price may rise further.