The Swing Overview - Week 14

Equity indices weakened last week on news of rising interest rates and a tightening of the US economy. The euro is also weakening not only because it is under pressure from the ongoing war in Ukraine and sanctions against Russia, but also from the uncertainty of the upcoming French presidential election. The outbreak of the coronavirus in China has fuelled negative sentiment in oil, where the market fears an excess of supply over demand. The US dollar was the clear winner in this environment.

The USD index strengthens along with US bond yields

According to the US Fed meeting minutes released on Wednesday, the Fed is prepared to reduce its balance sheet by the USD 95 billion per month from May this year. In addition, the Fed is ready to raise interest rates at a pace of 0.50%. Thus, at the next meeting, which will take place in May, we can expect a rate increase from the current 0.50% to 1.00%. This option is already included in asset prices.

As a result of this the yields on US 10-year bonds continued to rise and has already reached 2.64%. The US dollar in particular is benefiting from this development and is approaching the level 100.

Figure 1: US 10-year bond yields and USD index on the daily chart

Equity indices under pressure from high interest rates

The prospect of aggressive interest rate hikes is having a negative impact on investor sentiment, particularly for growth stocks. However, it is positive for financial sector stocks.

High yields on the US bonds are attractive to investors, who will thus prefer this yield to, for example, investments in gold, which does not yield any interest.

Figure 2: SP 500 on H4 and D1 chart

Figure 2: SP 500 on H4 and D1 chart

The US SP 500 index is currently moving in a downward correction, which is shown on the H4 chart. Prices could move in a downward channel that is formed by a lower high and a lower low. The SP 500 according to the H4 chart is below the SMA 100 moving average, which also indicates bearish tendencies.

The nearest resistance according to the H4 chart is in the range of 4,513 - 4,520. The next resistance is around 4,583 - 4,600. A support is at 4 450 - 4 455.

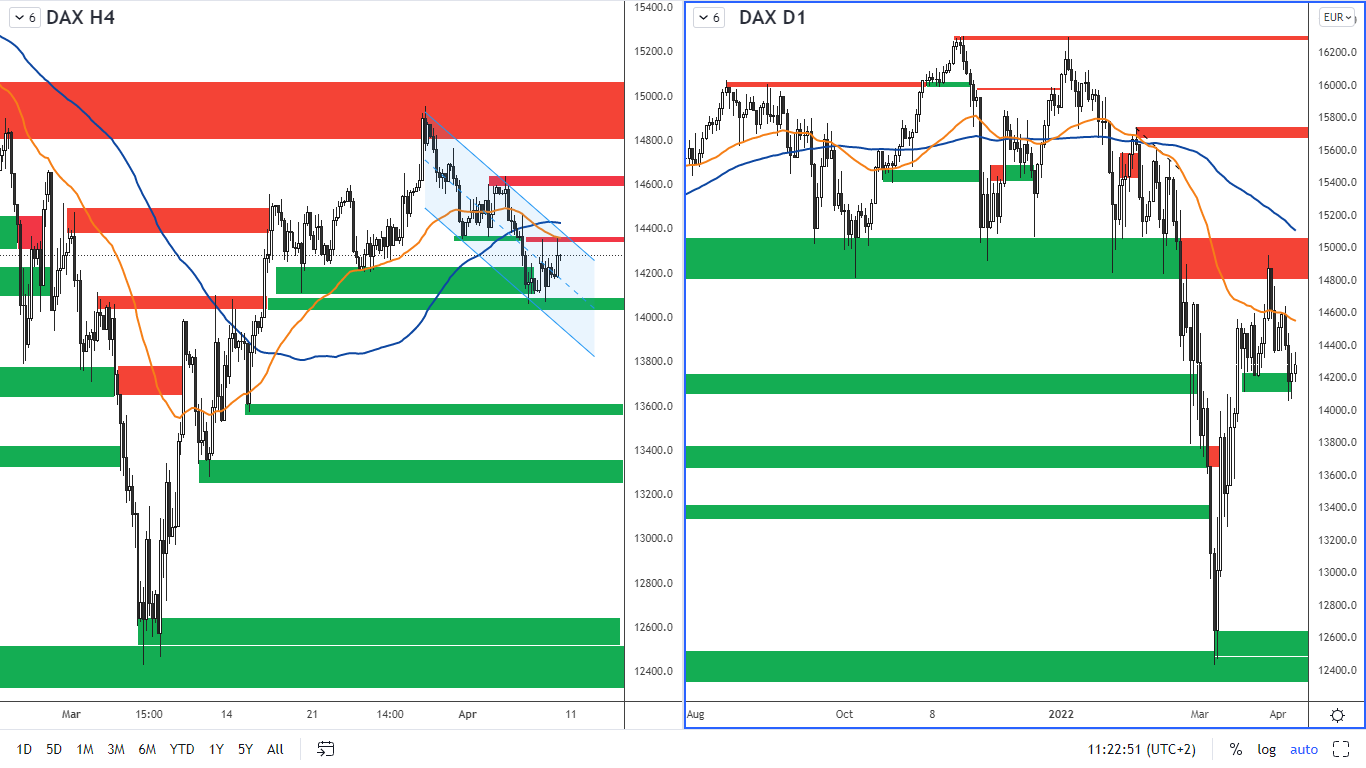

German DAX index

A declining channel has also formed for the DAX index. The price is below the SMA 100 moving average on the H4 chart, where at the same time the SMA 100 got below the EMA 50, which is a strong bearish signal.

Figure 3: German DAX index on H4 and daily chart

Figure 3: German DAX index on H4 and daily chart

According to the H4 chart, the nearest resistance is in the range between 14,340 - 14,370. There is also a confluence with the moving average EMA 50 here. The next resistance is at 14,590 - 14,630. A support is at 14,030 - 14,100.

The DAX is influenced by the upcoming French presidential election, the outcome of which could have a major impact on the European economy.

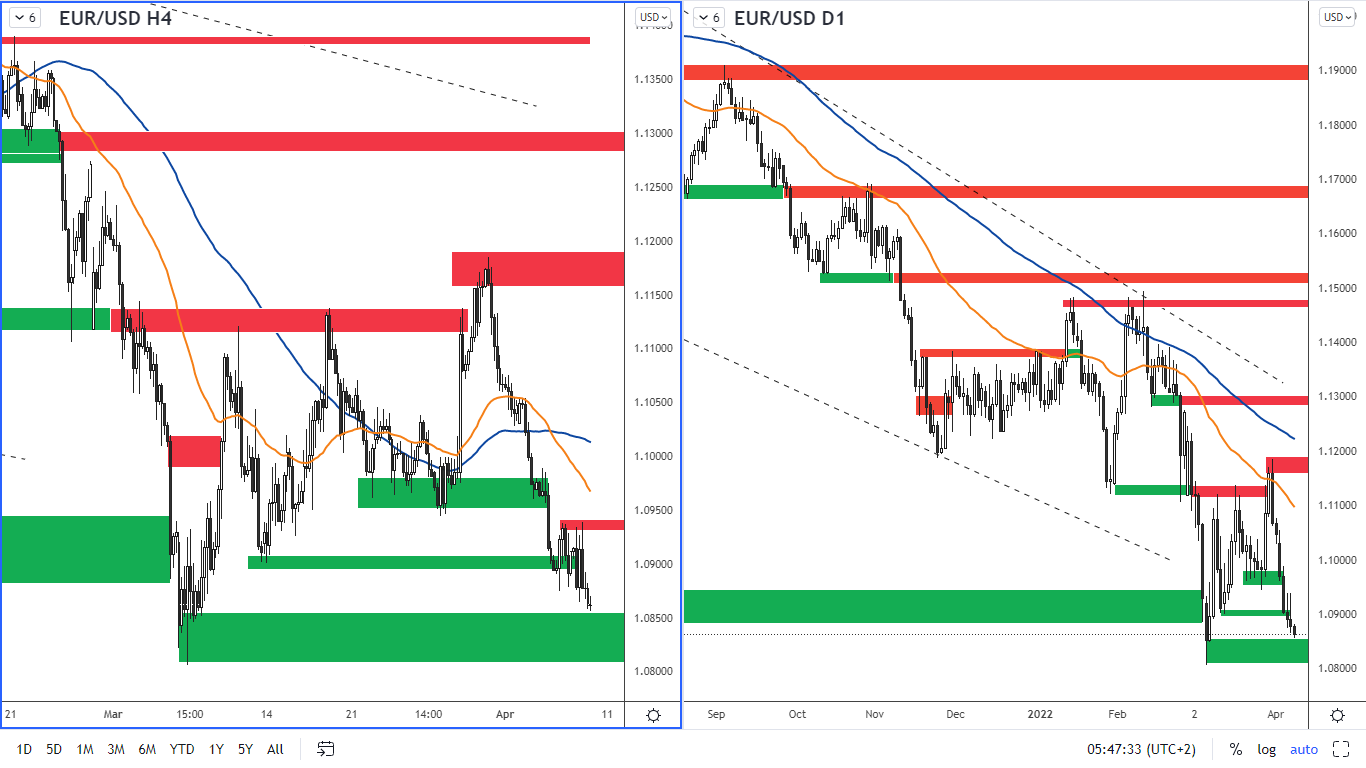

The euro remains in a downtrend

The Euro is negatively affected by the sanctions against Russia, which will also have a negative impact on the European economy. In addition, uncertainty has arisen regarding the French presidential election. Although the victory of the far-right candidate Marine Le Pen over the defending President Emmanuel Macron is still unlikely, the polls suggest that it is within the statistical margin of error. And this makes markets nervous.

A Le Pen victory would be bad for the economy and France's overall international image. It would weaken the European Union. That's why this news sent the euro below 1.09. The first round of elections will be held on Sunday April 10 and the second round on April 24, 2022.

Figure 4: EURUSD on H4 and daily chart.

Figure 4: EURUSD on H4 and daily chart.

The nearest resistance according to the H4 chart is at 1.0930 - 1.0950. The significant resistance according to the daily chart is 1.1160 - 1.1190. A support is at 1.080 - 1.0850.

According to the technical analysis, the euro is in a downtrend, but as it is currently at significant support levels, any short speculation could be considered only after the current support is broken and retested to validate the break.

The crude oil continues to descend

The oil prices fell for a third straight day after the Paris-based International Energy Agency (IEA) announced it would release 60 million barrels of its members' reserves to the open market, adding to an earlier reserve release of 180 million barrels announced by the United States. In total, 240 million barrels would be delivered to the market over six months, resulting in a net inflow of 1.33 million barrels a day.

That would be more than triple the monthly production additions of 400,000 barrels per day by the world's oil producers under the OPEC+ alliance led by Saudi Arabia and controlled by Russia.

Adding to the negative sentiment on oil was a coronavirus outbreak in Shanghai, the largest in two years, which forced a more than week-long closure of China's second-largest city. This raises concerns about demand among oil consumers in the Chinese economy, which has a significant impact on prices.

Figure 5: Brent crude oil on the H4 and daily charts.

Figure 5: Brent crude oil on the H4 and daily charts.

Brent crude oil is thus approaching support, which according to the H4 chart is at around USD 97-99 per barrel. The nearest resistance according to the H4 chart is at the price of USD 106 per barrel. The more significant resistance is at USD 111-112 per barrel of the Brent crude.