The Swing Overview – week 4

The sell-off in stock indices continued last week. The NASDAQ is already more than 17% below its peak and the SP 500 is losing 11%. The euro broke key support and the Gold did not perform well either as it fell back below $1,800 per ounce. On the other hand, the US dollar strengthened, reaching its highest level since July 2021. The reason for this development was the US Fed meeting and the growing tensions over Ukraine.

The Fed meeting

By far the most important news of last week was the Fed meeting. At its meeting on Wednesday, the Fed decided to leave interest rates unchanged near zero. However, the Fed hinted that it is likely to raise rates in March, as widely expected, and confirmed plans to end bond purchases this month. Then there will be a phase of significant reduction in the amount of assets held by the central bank.

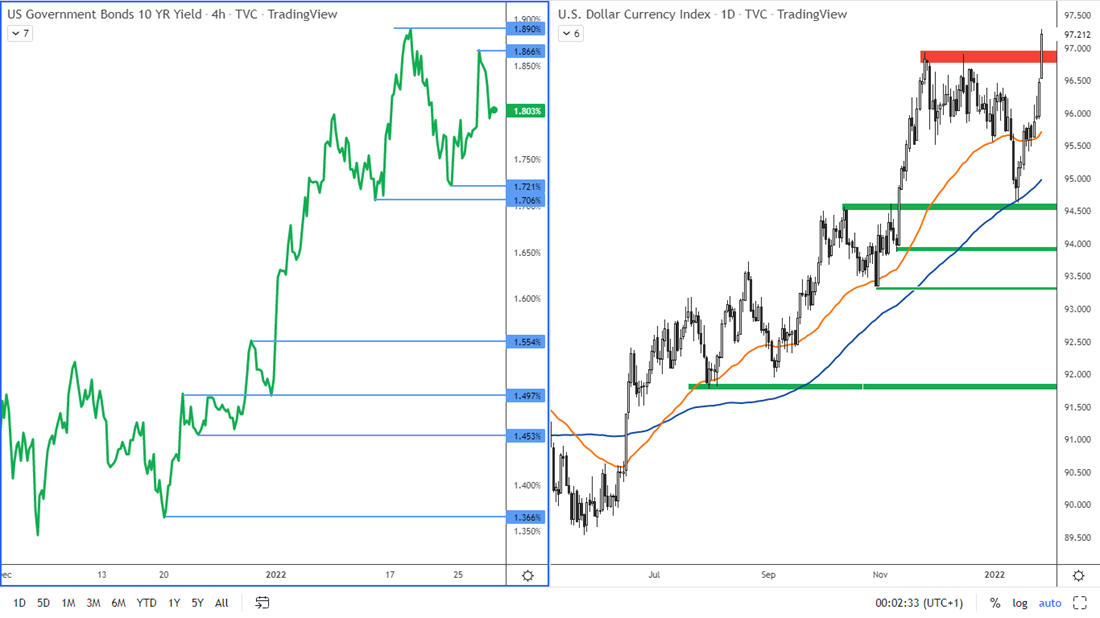

The fed funds futures market is now pricing in almost five rate hikes this year in the wake of Powell's remarks. The prospect of faster or larger US interest rate hikes helped the dollar rise to its highest value in seven months. The USD index broke through the resistance level at 97.00.

Figure 1: 10-year government bond yield on the 4H chart and USD index on the daily chart

Figure 1: 10-year government bond yield on the 4H chart and USD index on the daily chart

The yield on the benchmark 10-year government bond rose to 1.869%. Demand for US Treasuries then acts as fuel for the strengthening US dollar.

The US macroeconomic data

The US economy grew at an annualised rate of 6.9% in Q4 2021, much higher than the 2.3% in Q3 and well above forecasts of 5.5%. This is the strongest GDP growth in five quarters. Taking the full year 2021 into account, the economy grew by 5.7%, the most since 1984.

Figure 2: Quarterly GDP in the US

The question is how the Fed will evaluate this strong data. Paradoxically, strong data may have a negative impact on equity indices due to concerns that the Fed would have an argument to tighten the economy more significantly.

The NASDAQ and SP500

Wall Street weakened strongly last week. However, both indices have reached strong supports. A mix of positive economic news with mixed corporate earnings, geopolitical unrest and the prospect of a tightening economy have led to increased volatility in the markets. Thus, there has been a great deal of uncertainty in the markets throughout the month of January.

"This market is schizophrenic," said Tim Ghriskey, senior portfolio strategist at Ingalls & Snyder in New York. "There are some people who believe that everything negative has been read, and there are others who believe the worst is yet to come."

Beyond economic results, geopolitical tensions are weighing on the market as Russia continues to build up troops along Ukraine's border while diplomats try to prevent conflict in the region.

We have both indices in Figure 3 on the daily chart. In both cases we see that the correction from the clear uptrend has deepened. The NASDAQ index has already written down more than 17% from its peak, and the SP 500 has lost more than 11%. This dip will attract some investor to buy it.

Figure 3: US NASDAQ and SP 500 indices on D1 chart

The correction in indices is strong but there are signs of consolidation of this decline. On January 24, a bullish pin bar formed on the daily chart on both indices, which tends to be a reversal formation. Let's see if that proves to be the case here.

In the NASDAQ index, support is in a fairly wide range of 13,727 - 13,928. If this area is broken to the downside, then the next support could be at a range around 13,400 - 13,500.

In the SP 500 index, support has formed in the 4,225 - 4,313 band.

The German DAX index

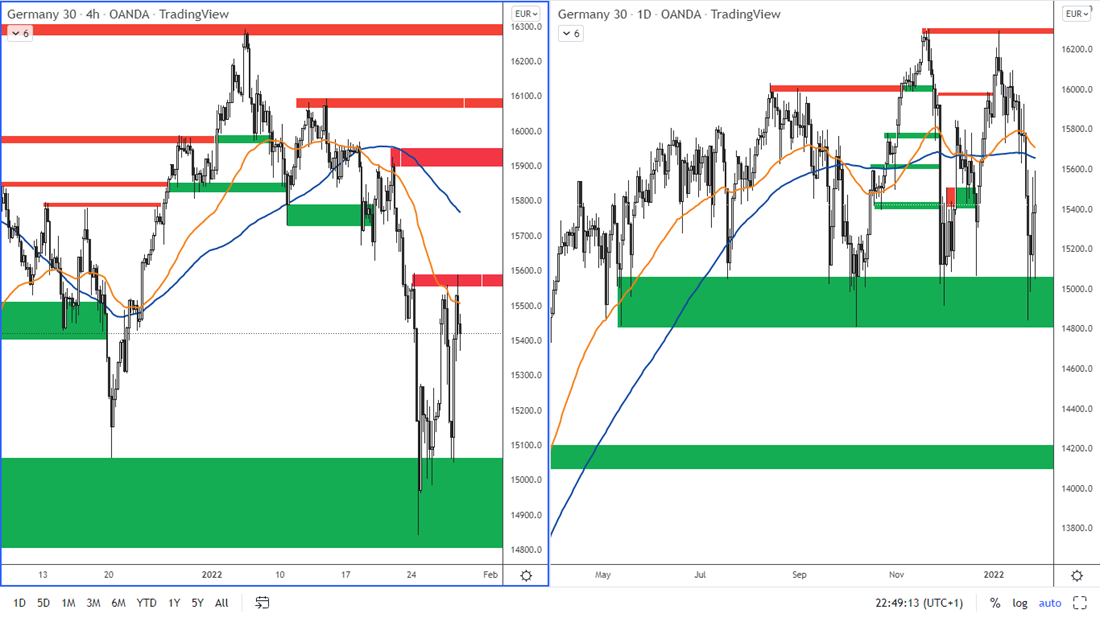

The DAX index fell in tandem with the US indices and reached a very strong support area.

Figure 4: DAX on H4 and daily chart

The Support is in the area between 14,800 - 15,000. The Resistance according to the 4 H chart is at 15,530 - 15,590.

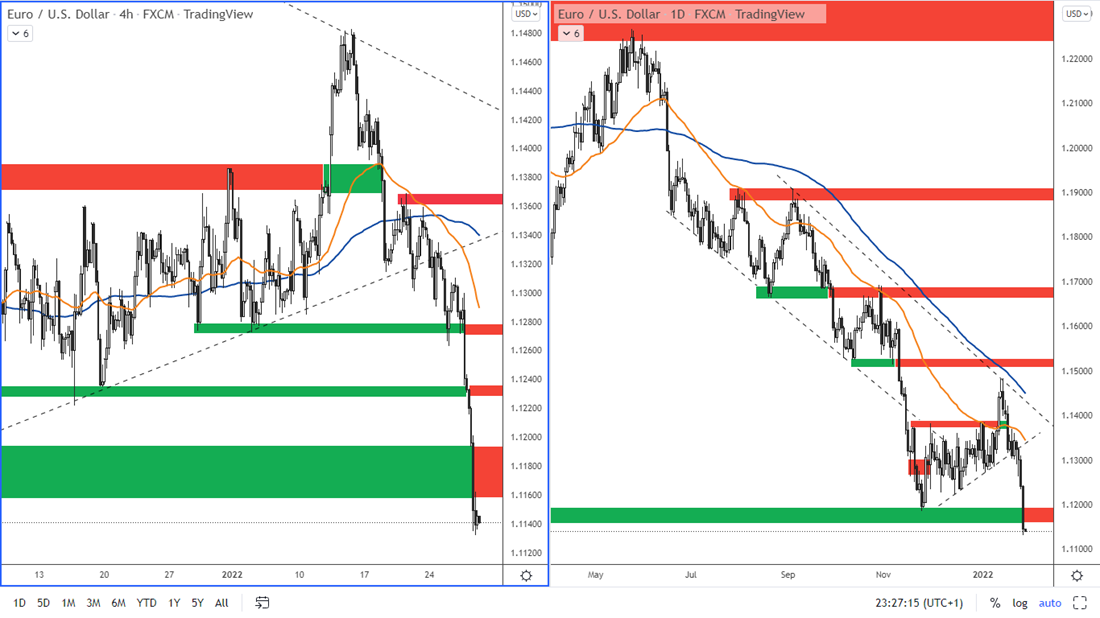

The EUR/USD broke key support

Euro USD is in a strong inverse correlation with the USD index. Therefore, it is no surprise that when the USD index is rising strongly, the EURUSD is falling.

Figure 5: The EURUSD on H4 and daily chart

The euro broke the lower rising trend line of a consolidation formation in a downtrend last week and also broke support at 1.1160, which has now become the new resistance. The nearest resistance is therefore, according to the H4 chart, in the area at 1.1160 - 1.1200. Next support is at 1.10.

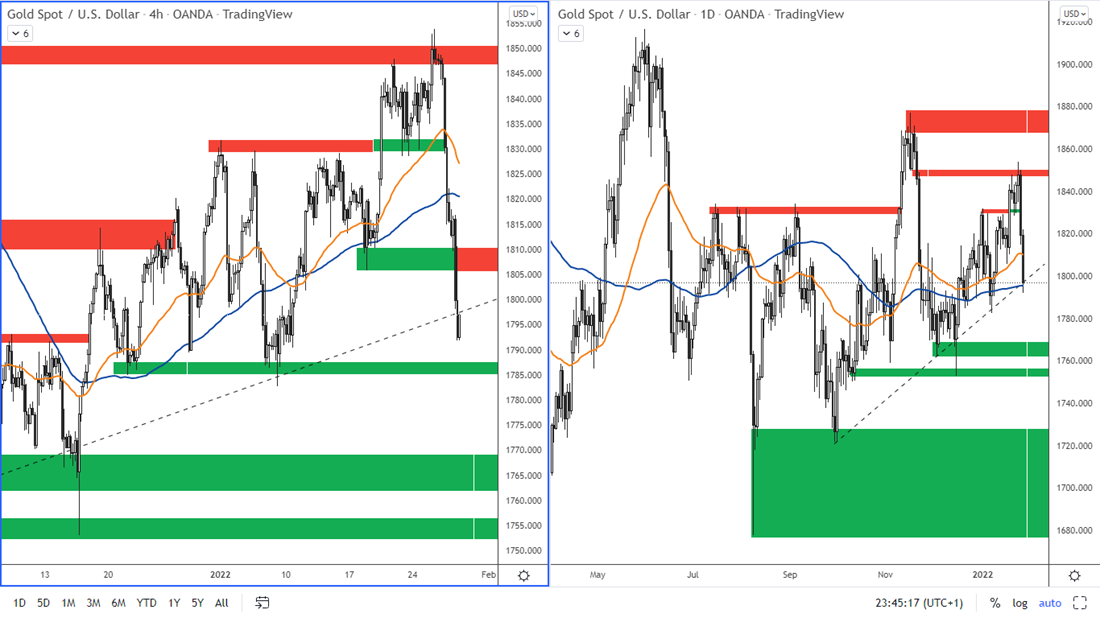

The Gold is below 1,800 again

Gold is paying for the developments in the US bonds. The bonds are yield bearing while the gold is not.

Figure 6: The Gold on H4 and daily chart

Figure 6: The Gold on H4 and daily chart

Last week, the gold reached the resistance level at $1,850 per ounce, from which it bounced back down and the price is below the key 1,800 level, which can also be seen as a resistance value. The closest support in gold is at 1,783 - 1,788 according to the H4 chart. The next strong support is then at $1,769-$1,762 per ounce.