Apple - an opportunity to buy before the introduction of the iPhone 14?

The third most traded company over the summer was Apple. It has been relatively "successful" so far this year, with its shares down 14%. Of course, that's no miracle; we're used to better performances from Apple. But the company has at least outperformed the S&P 500, which has written off over 18% over the same period. Its most important component, like other companies, has had a challenging year. Just as Apple's brick-and-mortar stores around the world finally began to reopen, Russia stomped its way to Ukraine. Apple thus stopped selling its products all over Russia in early March. While Russia only accounts for about 1% of Apple's total revenue, the bigger problem is the rising cost of commodities and energy as a result of Russia's incursion into Ukraine. Like other companies, Apple is also struggling with the strong dollar, which is negatively impacting sales outside the US. In 2021, Apple will generate approximately ⅔ of its total sales outside the US.

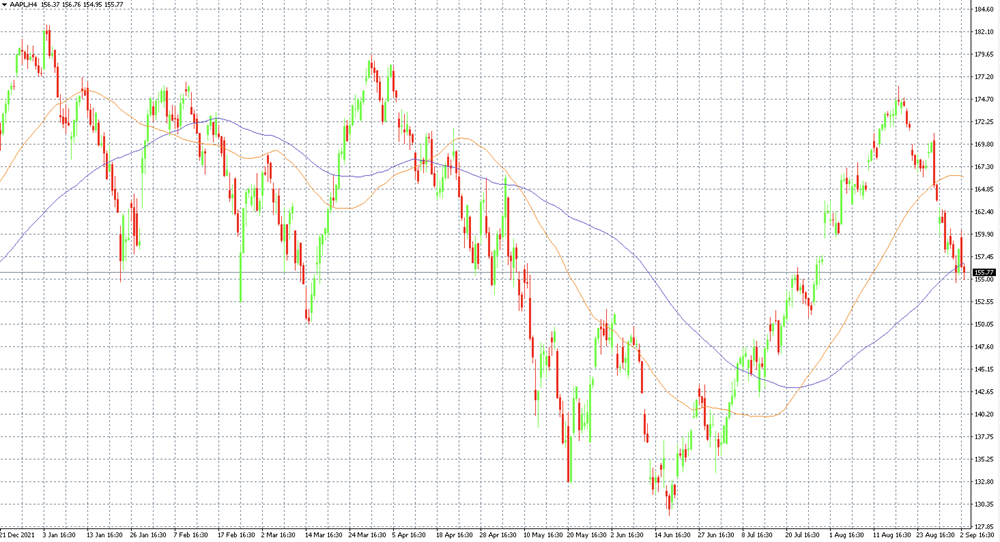

Chart 3: Shares of Zoom Technologies on the MT4 platform on the H4 timeframe along with the 50 and 100 day moving averages

Despite the aforementioned difficulties, the company's recent economic results were quite good. Revenues grew by 2% year-on-year to USD 83 billion and profits reached USD 19.4 billion. Both indicators exceeded expectations. Margin growth is also encouraging, rising to 43.26% last quarter. In addition, Apple is expecting to introduce new products in the current quarter. We should see a new line of iPhone 14 phones, Apple Watch 8, and AirPods headphones. The Christmas season is also approaching, which is literally a goldmine for Apple. The fourth quarter is traditionally the company's strongest.

So is now a good buying opportunity? Historically, new product introductions have not had much of an impact on the stock price, so traders should focus more on fundamentals. While Apple is capable of thriving in virtually any situation, the slowing revenue growth of the services section, which has been a big driver in recent quarters, as well as the shortage of parts is alarming. The latter had a negative impact of around USD 4 billion last quarter. Thus, until the third quarter earnings are announced, Apple stock is likely to fluctuate according to the overall market sentiment. This has been rather negative in recent weeks.