The sectors that are currently "pulling"

Investors may now be wise to avoid cyclical stocks - that is, companies whose financial performance is significantly dependent on the economic cycle. Companies like Netflix or Starbucks may be under pressure as a result, as they will be one of the first places consumers save in times of belt-tightening. The same can be said for luxury goods companies.

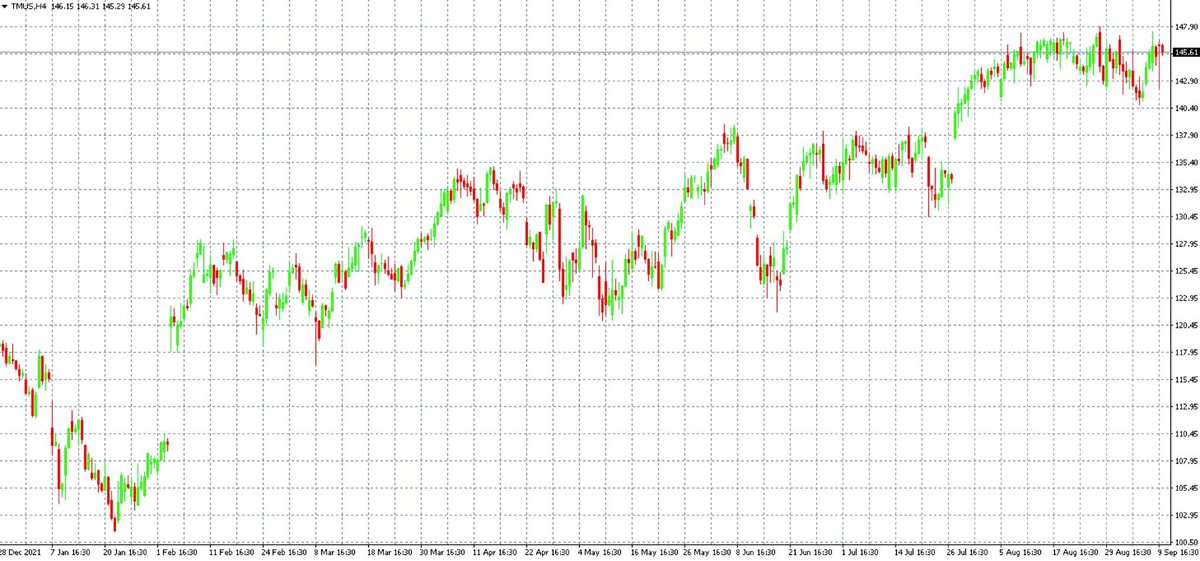

So it may now be more interesting to seek out so-called defensive stocks - that is, stocks of companies that generally outperform the market even in times of uncertainty. But that doesn't mean that these stocks can't fall in the event of a market washout. Defensive stocks include, for example, mobile phone operators. For example, if you look at a chart of T-Mobile US (ticker TMUS), you might be shocked to see that this stock is trading near an all-time high. Thus, T-Mobile US stock has completely ignored the indices this year, having gained nearly 30% since the beginning of the year (see chart below).

Other examples of defensive stocks include companies whose business revolves around electricity or water - things that are hard to reduce consumption of. Counter-cyclical stocks can also be an interesting choice - by this we mean companies that, in contrast, increase their revenues in times of belt-tightening. There aren't many such companies, but one example is the low-priced goods chain Dollar Tree.

TMUS stocks