What price action trading helps us track?

While using the price action method in trading, we have to focus on several things:

- Trends

- Support and resistance levels

- Price response on support and resistance levels.

- Candlestick formations

- Price patterns or formations

The crucial thing in the market in relation to price action trading is the market's context or structure. When trading with the price action, you need to look at the market in certain contexts that provide us with comprehensive information. The market structure is not determined by one or two candlesticks, but it requires a much broader view of the market.

In addition, we will alsobe interested in the length of the candlesticks, whether the candlesticks are close to their highs or lows, whether one color of candlesticks predominates, how fast they reach a certain level, etc. Based on this, we can then identify impulsive movements and corrections.

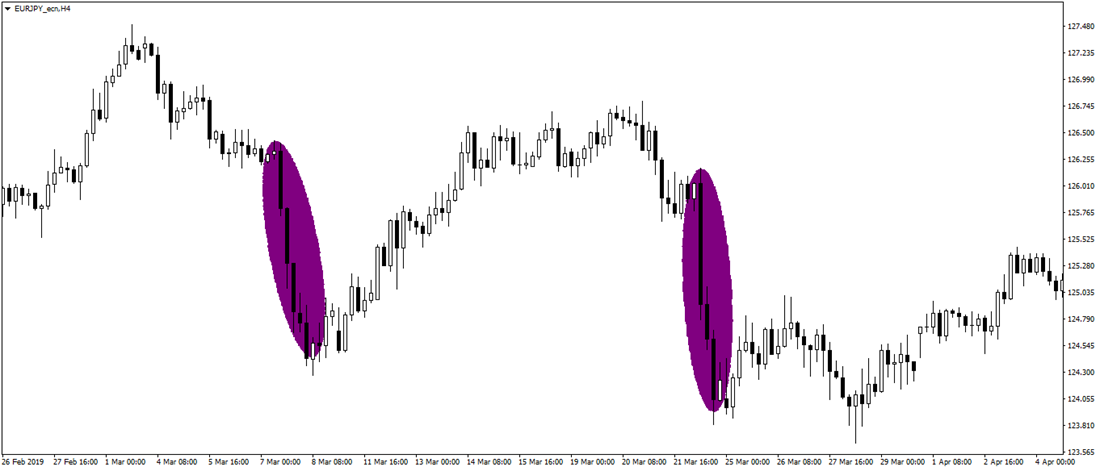

Impulsive movement can be characterized as a movement where long candlesticks are present, candlesticks close near to their highs or lows, and one color of candlesticks predominates within this impulsive movement. Impulsive movements are often very fast. Trading against impulsive movements is very risky.Two examples of bearish impulsive movements are shown in Figure 1. In the highlighted area, you can see long black candles closing near their lows

Impulsive movements in price action trading

On the other hand, the corrective movement is a movement where the candlesticks are usually shorter and they often alternate. The movement also takes a longer time. The corrective movement follows the impulsive movement and is usually directed against it.The corrective movement is used for timing the trade in the direction of the previous impulsive movement.