Investors are preparing for rising commodity prices

Investors and analysts agree that the sharp rise in commodity prices since the beginning of the year is only the beginning of a bullish trend in 2021. Growth is supported by excess liquidity in the financial sector, but also by the gradual vaccination of the world's population, which is returning the economy. Some even talk about the "supercycle" of the new millennium and recommend including more commodities in their portfolios.

Commodities as a part of the investment portfolio

Raw materials that are listed on the stock exchange and that were on the decline last year could start catching up in 2021. Banks on Wall Street have even begun recommending that their clients increase their exposure to the commodity market, as they are likely to capitalize on an improving economic recovery driven by vaccinations and a new fiscal stimulus in the United States. Some investors even predict the repetition of a long cycle of commodity growth called the "supercycle," in which oil and precious metal prices rose to record highs at the beginning of the millennium. In the commodity market, we can probably see the V-shaped recovery which was mentioned several times and which is helped by vaccination.

Unusual growth of all commodities at once

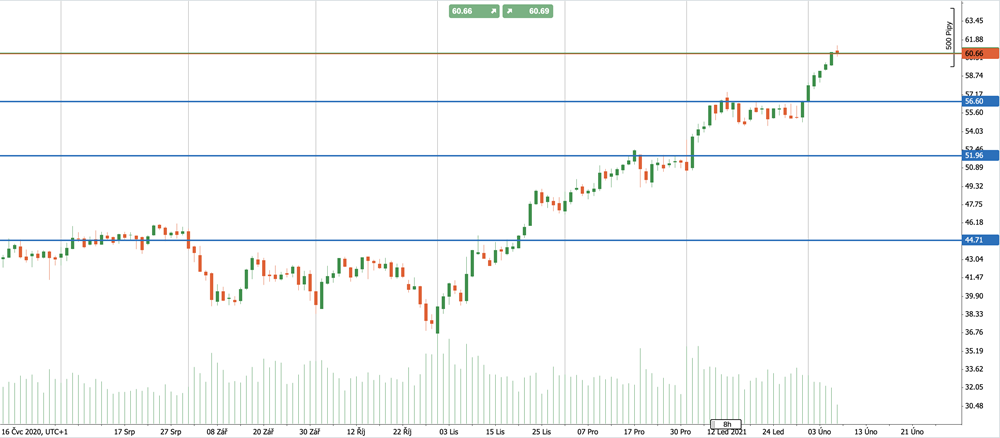

The rise in oil prices has attracted the most attention in recent weeks. It has reached the highest levels since the beginning of last year, but along with it are growing also other commodities that have been out of the radar of investors for the last 10 years. In recent months, the growing demand from China, as one of the largest importers of commodities in the world, has been helping. Soybean prices have been 50% higher over the last year, while copper has risen by 40%. Brent North Sea crude oil climbed to over $ 60 a barrel on Monday, and U.S. WTI crude oil stopped just below $ 59. This shows us that growth is extremely vehement. And it’s not only certain commodities that are doing well but rather the whole basket of them, from coffee to nickel. This has not happened in the last 50 years, which is very unusual.

Chart: Brent Daily Oil Chart (Source: PurpleTrading cTrader)

Supercycle

However, some investors are taking the views on the "supercycle" with a grain of salt. According to them, we are currently seeing a cyclical recovery, which is mainly driven by the recovery of stocks in Europe, the USA, and China after a supply outage during a pandemic. Above all, we should attribute current growth to unprecedented fiscal and monetary policies that help rise inflation and force hedge funds to protect themselves by buying current hedging assets such as precious metals or oil.

Will USD help?

It is also impossible not to consider the US dollar factor, as it expresses the prices of most commodities. It weakened significantly last year to two-and-a-half-year lows, which boosted demand for commodities, but now it seems to correct previous losses. For the rest of the year, however, there is not much to be desired from the dollar and due to the current increase in fiscal stimulus in the US, its value will continue to weaken. This gives investors a fundamental confirmation that they should start allocating part of their capital in commodities. At the beginning of 2021, the so-called "yield hunt" began, when investors no longer see much room in stock markets and are looking for appreciation either in emerging markets or in commodities.