Planned regulation ESMA: A real restriction for traders or just a scarecrow?

The trading world is being shaken to its foundation with new regulations. Everything that is related to new ESMA regulation, as well as to its impact not only on Forex but on financial markets as such, has become a thorny issue. Some say that these regulations will bring the forex as we know it to an end!

Are such worries legitimate and is the forex as we know it coming to an end, or is it all just about the transition from gambling to trading for some traders?

What will the new regulations bring?

Except for ESMA’s (European Securities and Markets Authority) new regulation, restricting trading with binary options, the most important change from the forex point of view is the maximum level of offered financial leverage and protection against negative balance on trading accounts.

After the regulation becomes effective, the maximum offered financial leverage for respective instruments will be as follows:

| Type of instrument |

New maximum financial leverage |

| Forex - majors |

1:30 |

| Other FX pairs |

1:20 |

| Gold and major indices |

1:20 |

| Other commodities and stocks |

1:10 |

| CFD on stocks |

1:5 |

| CFD on cryptocurrencies |

1:2 |

How will the regulation affect potential profit and risks?

According to the statistics, 75% of minor traders using high financial leverage are in a long-term loss. Financial leverage regulation is designed to reduce such a high percentage and to lower the risks leading to a long-term negative balance on trading accounts at the same time.

There is a general rule in trading – the higher the risk, the higher the potential profit. This is definitely true, but in this specific case we have to take the percentage of losing traders into accounts. This percentage shows that the majority of minor traders are not profiting from a high financial leverage, on the contrary, they are losing.

Regulation will limit larger volume of trades via margin

There are discussions pointing to the presumption that if the traders are limited in using high financial leverage, they won’t be able to keep their current trading strategy, as they won’t have enough funds for sufficient margin.

The traders’ worries are based on the fact that after the implementation of amended financial leverage limit (1:30), the traders will need 333 USD to open 0.1 lot on EUR/USD. In these dazs, with a financial leverage of 1:100, they need only 100 USD.

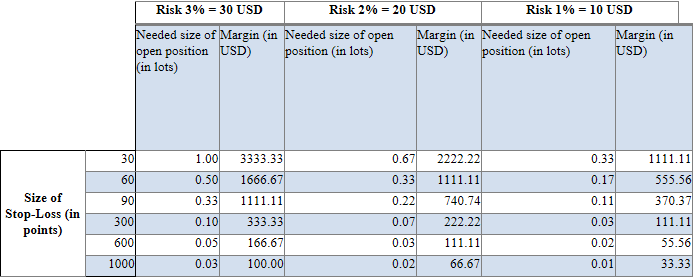

Let’s take a look on the changes of necessary financial margin (with 1:30 financial leverage) depending on the given risk and different sizes of Stop-Loss. To make the example as simple as possible, let’s take a fictitious position on EUR/USD pair. It’s simple because if we open a position of 1 lot, then the change of current price by one point equals 1 USD. To be more specific, 10 points = 1 pip and the deposit is 1,000 USD.

Will the new financial leverage bring any complication?

It is evident from the table above that the financial leverage reduction will affect traders specialized on scalping the most (see table => size of Stop-Loss – 30, 60, 90 points), as these traders set up their Stop-Losses only a few tens of points from the entry position in general, trying to make use of small changes in the market with a large volume of trades.

For normal intraday, swing, mid-term and long-term traders (who focus on changes on the market from hundreds and thousands of points), i.e. for the majority of all forex traders, the change of financial leverage shouldn’t affect the execution of contracts (if they follow the basic conventions of right and disciplined trading). This applies even in cases when they want to take a higher risk of their capital.

The table above serves only as a representative example and not as a tool to determine the volume size. Logically, positions of 1 lot and more shouldn’t be even opened, as the balance of the account is 1,000 USD.

Note: With a deposit of $1,000, usually only microlot volumes are traded.

Is the change really going to affect the traders then?

The financial leverage changes will affect the financial market world without a doubt. However, it shouldn’t be too big of an issue for the traders to deal with.

Even for the traders focusing on scalping, it will be sufficient to appropriately choose the sizes of their trading positions, which will allow then to keep on gaining solid profits without putting their trading accounts at extreme risk.

It is important to add that, for example, the majority of our clients and investment strategy providers do not actually use the currently available financial leverage up to 1:100. Even though it is technically set-up in the platform, they are effectively using the financial leverage of e.g. 1:10 or 1:20. For such conservative traders, this limitation will mainly require changing their mental approach rather than a real restriction. For commodities and indices, we had a fixed leverage of 1:50 or 1:20, and even this wasn’t actively being used by the traders, which means the impact might not be as harsh anyway.

Aren’t sure how the change will affect your trading? Ask us!

As a real partner, we have something extra for our clients and we will be happy to show you how and if the ESMA regulation is going to affect your trading.

Our specialists have created an exclusive system, monitoring the current use of margin on trading accounts of all of our clients, and at the same time it simulates what would be the use of the margin according to the new conditions. After couple of weeks we can already evaluate the level of your used margin right now, and compare it with the use after the regulation will have become effective, and determine whether the new regulation will be limiting or not. Thanks to that, you will have a clear idea of how to adjust the amount of funds or your trading strategy, or whether the new regulation will actually not affect you in any way.

If you are interested, please do not hesitate to contact us. We will be happy to discuss the current use of margin on your trading account.