The British Pound

|

date

|

Open Interest

|

Specs Long

|

Specs Short

|

Specs Net positions

|

change Open Interest

|

change Long

|

change Short

|

change Net Positions

|

Sentiment

|

|

Feb 15, 2022

|

195302

|

50151

|

47914

|

2237

|

-2646

|

5442

|

-5340

|

10782

|

Bullish

|

|

Feb 08, 2022

|

197948

|

44709

|

53254

|

-8545

|

13941

|

15112

|

52

|

15060

|

Weak bearish |

|

Feb 01, 2022

|

184007

|

29597

|

53202

|

-23605

|

1967

|

-7069

|

8773

|

-15842

|

Bearish

|

|

Jan 25, 2022

|

182040

|

36666

|

44429

|

-7763

|

-1194

|

-3094

|

4422

|

-7516

|

Bearish

|

|

Jan 18, 2022

|

183234

|

39760

|

40007

|

-247

|

-17259

|

9254

|

-19665

|

28919

|

Weak bearish

|

|

Jan 11, 2022

|

200493

|

30506

|

59672

|

-29166

|

486

|

4526

|

-5479

|

10005

|

Weak bearish

|

| |

|

|

|

Total change

|

-4705

|

24171

|

-17237

|

41408

|

|

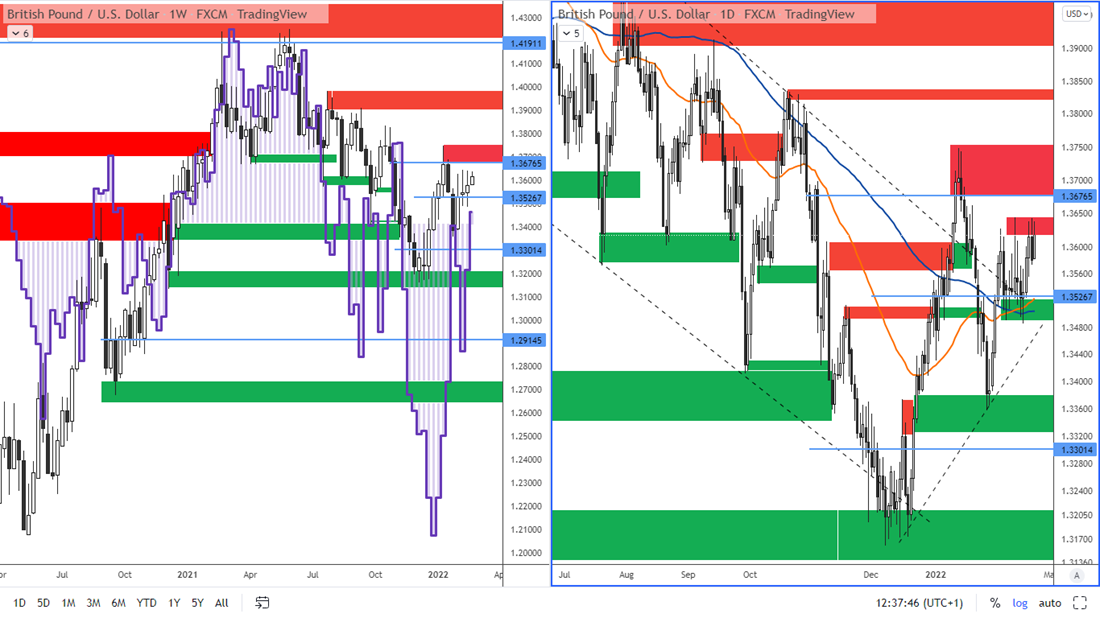

Figure 2: The GBP and COT positions of large speculators on a weekly chart and the GBPUSD on D1

The total net positions of speculators reached 2,237 contracts last week, up by 10,782 contracts compared to the previous week. This change is due to an increase in long positions of 5,442 contracts and a decrease in short positions of 5,340 contracts.

Total net positions have increased by 41,408 contracts over the past 6 weeks. This change is due to speculators exiting 17,237 short positions and adding 24,171 long positions.

This data suggests bullish sentiment for the pound.

Open interest, which fell by 2,646 contracts last week, is indicating that the bullish price action that occurred in the pound last week was not supported by volume and therefore it is weak.

Risk off sentiment in US equities could have a negative effect on the Pound as well as the Euro, which could then send the Pound towards support which is at 1.3380.

Long-term resistance: 1.3620-1.3640. Next resistance is near 1.3680 – 1.3750.

Support: 1.3490 – 1.3520. A next support is near 1.3320 – 1.3380 and then mainly in the zone near 1.3200.