Positions of large speculators according to the COT report as at 7/5/2021

The total net positions of speculators in the USD index fell by 600 contracts last week. This change is the result of a decrease in net long positions by 1,800 contracts and a decrease in net short positions by 1,100 contracts.

The total net positions of speculators increased last week in the euro, the Australian dollar, the New Zealand dollar, the Canadian dollar, the Swiss franc and the Japanese yen.

The decline in the total net positions of speculators occurred in the pound.

There is still a risk on sentiment in the market as US stock indices hovering near their historic highs and the Dow Jones 30 setting a new historic high last week. In such environment, commodity currencies and the euro tend to strengthen.

In addition to that, the recent developments in the US dollar pairs have been determined by developments in the US long-term bond yields. They fell last week and the US dollar weakened. However, in the event of their further stronger growth, it cannot be ruled out that the dollar could start to strengthen again.

The positions of speculators in individual currencies

The total net positions of large speculators are shown in Table 1: If the value is positive then the large speculators are net long. If the value is negative, the large speculators are net short.

|

|

7/5/2021

|

30/4/2021

|

23/4/2021

|

16/4/2021

|

9/4/2021

|

2/4/2021

|

|

USD index

|

2,100

|

2,700

|

3,500

|

6,000

|

4,400

|

5,700

|

|

EUR

|

84,800

|

81,000

|

80,800

|

66,900

|

67,500

|

73,700

|

|

GBP

|

19,800

|

29,200

|

25,200

|

25,600

|

20,000

|

25,000

|

|

AUD

|

1,500

|

-1,400

|

-1,800

|

3,800

|

4,100

|

12,300

|

|

NZD

|

8,600

|

7,000

|

4,300

|

2,500

|

3,100

|

4,000

|

|

CAD

|

25,900

|

15,722

|

13,200

|

2,400

|

2,700

|

6,500

|

|

CHF

|

100

|

-700

|

-1,600

|

800

|

3,200

|

4,300

|

|

JPY

|

-41,500

|

-48,500

|

-59,800

|

-58,300

|

-58,000

|

-59,500

|

Table 1: Total net positions of large speculators

Notes:

Large speculators are traders who trade large volumes of futures contracts, which, if the set limits are met, must be reported to the Commodity Futures Trading Commission. Typically, this includes traders such as funds or large banks. These traders mostly focus on trading long-term trends and their goal is to make money on speculation with the instrument.

The total net positions of large speculators are the difference between the number of long contracts and the number of short contracts of large speculators. Positive value shows that large speculators are net long. Negative value shows that large speculators are net short. The data is published every Friday and is delayed because it shows the status on Tuesday of the week.

The total net positions of large speculators show the sentiment this group has in the market. A positive value of the total net positions of speculators indicates bullish sentiment, a negative value of total net positions indicates bearish sentiment.

When interpreting charts and values, it is important to follow the overall trend of total net positions. The turning points are also very important, i.e. the moments when the total net positions go from a positive value to a negative one and vice versa. Important are also extreme values of total net positions as they often serve as signals of a trend reversal.

Sentiment according to the reported positions of large players in futures markets is not immediately reflected in the movement of currency pairs. Therefore, information on sentiment is more likely to be used by traders who take longer trades and are willing to hold their positions for several weeks or even months.

Detailed analysis of selected currencies

Explanations:

-

Purple line and histogram in the chart window: this is information on the total net position of large speculators. This information shows the strength and sentiment of an ongoing trend.

-

Green linein the indicator window: these are the bullish positions of large speculators.

-

Red line in the indicator window: indicates the bearish positions of large speculators.

If there is a green line above the red line in the indicator window, then it means that the overall net positions are positive, i.e. that bullish sentiment prevails. If, on the other hand, the green line is below the red line, then bearish sentiment prevails and the overall net positions of the big speculators are negative.

Information on the positions of so-called hedgers is not shown in the chart, due to the fact that their main goal is not speculation, but hedging. Therefore, this group usually takes the opposite positions than the large speculators. For this reason, the positions of hedgers are inversely correlated with the movement of the price of the underlying asset. However, this inverse correlation shows the ongoing trend less clearly than the position of large speculators.

Charts are made with the use of www.tradingview.com.

Euro

|

Date

|

Weekly change in open interest

|

Weekly change in total net positions of speculators

|

Weekly change in total long positions of speculators

|

Weekly change in total short positions of speculators

|

Sentiment

|

| 7.5.2021 |

5,300 |

3,800 |

6,000 |

2,200 |

Býčí |

| 30.4.2021 |

10,400 |

200 |

3,300 |

3,100 |

Býčí |

| 23.4.2021 |

13,000 |

13,900 |

6,500 |

-7,400 |

Býčí |

Figure 1: The euro and COT positions of large speculators on a weekly chart

Figure 1: The euro and COT positions of large speculators on a weekly chart

The total net positions of speculators grew by 3,800 contracts last week. This change is due to an increase in long positions by 6,000 contracts and an increase in short positions by 2,200 contracts.

The price of the euro strengthened strongly last week and broke the declining line of resistance. After testing it back as a new support, we can expect a further strengthening of the euro against the dollar.

Long-term resistance: 1.2240 - 1.2350

Long-term support: 1.1700 - 1.1750

The British pound

|

Date

|

Weekly change in open interest

|

Weekly change in total net positions of speculators

|

Weekly change in total long positions of speculators

|

Weekly change in total short positions of speculators

|

Sentiment

|

| 7.5.2021 |

-8,500 |

-9,400 |

-7,700 |

1,700 |

Slábnoucí býčí |

| 30.4.2021 |

-3,000 |

-4,000 |

-1,100 |

-5,100 |

Býčí |

| 23.4.2021 |

15,500 |

-400 |

8,200 |

8,600 |

Slábnoucí býčí |

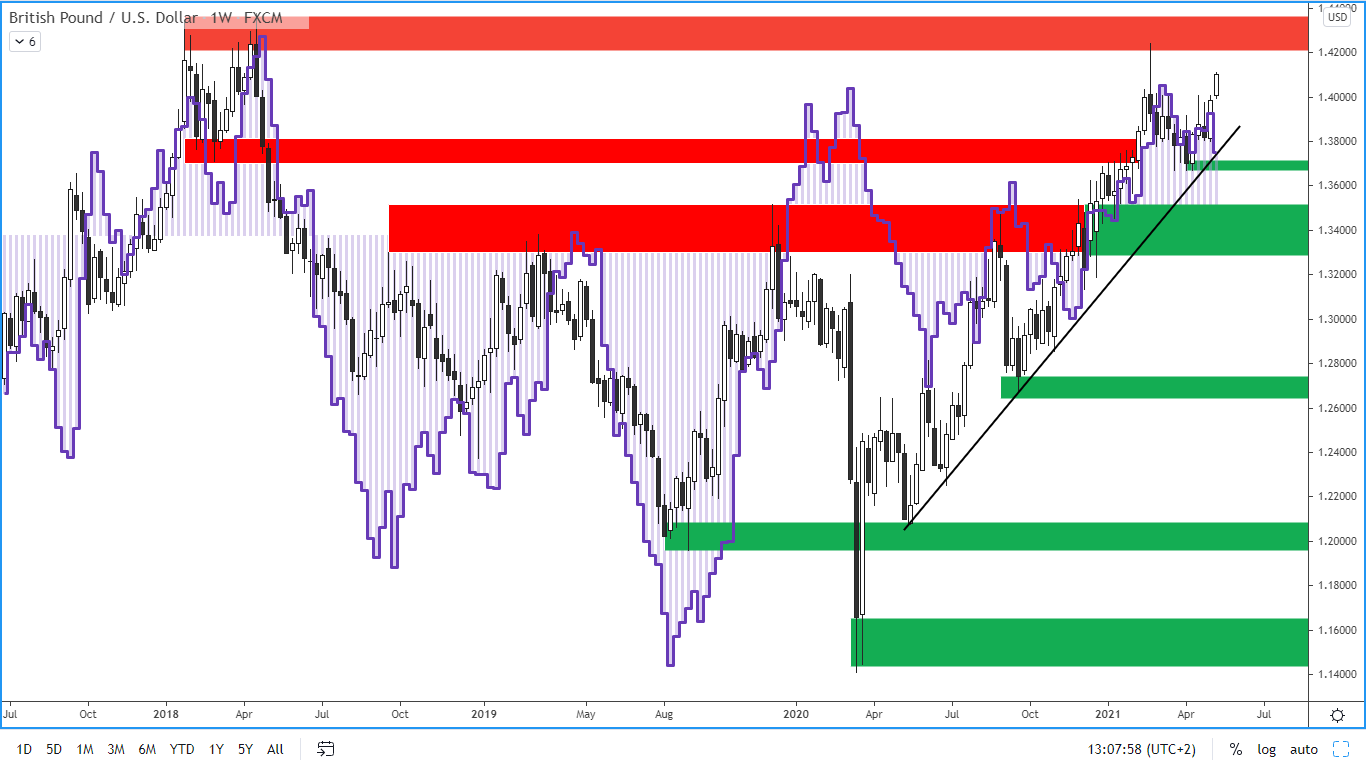

Figure 2: The GBP and COT positions of large speculators on a weekly chart

Figure 2: The GBP and COT positions of large speculators on a weekly chart

Last week, the total net position of speculators fell by 9,400 contracts. This change is the result of a decrease in net long positions by 7,700 contracts, while net short positions increased by 1,700 contracts.

The pound strengthened strongly against the US dollar last week.

Long-term resistance: 1.42-1.4350

Long-term support: 1.3670-1.3700

The Australian dollar

|

Date

|

Weekly change in open interest

|

Weekly change in total net positions of speculators

|

Weekly change in total long positions of speculators

|

Weekly change in total short positions of speculators

|

Sentiment

|

| 7.5.2021 |

-3,100 |

2,900 |

-1,400 |

-4,200 |

Býčí |

| 30.4.2021 |

4,600 |

400 |

3,000 |

2,600 |

Slábnoucí medvědí |

| 23.4.2021 |

-3,500 |

-5,600 |

-7,300 |

-1,700 |

Medvědí |

Figure 3: The AUD and COT positions of large speculators on a weekly chart

Figure 3: The AUD and COT positions of large speculators on a weekly chart

Last week, the total net positions of speculators grew by 2,900 contracts. This change is due to a decrease in long positions by 1,400 and a decrease in short positions by 4,200 contracts.

The Australian dollar strengthened strongly last week in line with risk on sentiment and is currently in the resistance zone.

Long-term resistance: 0.7870-0.8000

Long-term support: 0.7530-0.7600

The New Zealand dollar

|

Date

|

Weekly change in open interest

|

Weekly change in total net positions of speculators

|

Weekly change in total long positions of speculators

|

Weekly change in total short positions of speculators

|

Sentiment

|

| 7.5.2021 |

400 |

1,600 |

500 |

-1,100 |

Býčí |

| 30.4.2021 |

3,500 |

2,700 |

4,200 |

1,500 |

Býčí |

| 23.4.2021 |

2,200 |

1,800 |

2,000 |

200 |

Býčí |

Figure 4: The NZD and the position of large speculators on a weekly chart

Figure 4: The NZD and the position of large speculators on a weekly chart

Last week, total net positions grew by 1,600 contracts. This change is the result of an increase in long contracts by 500 and a decrease in short contracts by 1,100.

The NZDUSD also strengthened strongly last week in line with risk on sentiment. The movement of the NZDUSD pair is also strongly correlated with the AUDUSD.

Resistance: 0.7370-0.7450

The nearest support: 0.6900-0.6960