The Swing Overview - Week 27 2022

The fall in US bond yields, the rise in the US dollar and the sharp weakening in the euro, which is heading towards parity with the dollar. This is how the last week, in which stock indices cautiously strengthened and made a correction in the downward trend, could be characterised. It is worth noting that Germany has a negative trade balance for the first time since May 1991. Is the country losing its reputation as an economic powerhouse of Europe?

Macroeconomic data

The ISM in manufacturing, which shows purchasing managers' expectations of economic developments in the short term, came in at 53.0 for June. While a value above 50 still indicates an expected expansion in the sector, the trend since the beginning of the year has been declining, indicating worsening of optimism.

Unemployment claims reached 231,000 last week. This is still a level that is fairly normal. However, we note that this is the 6th week in a row that the number of claims has been rising. The crucial news on the labour market will then be shown in Friday's NFP data.

On Wednesday, the minutes of the last FOMC meeting were presented, which confirmed that another 50-75 point rate hike is likely in July. The minutes also stated that the Fed could tighten further its hawkish policy if inflationary pressures persist. The Fed's target is to push inflation down to around 2%.

The Fed's hawkish tone has led to a strengthening of the dollar, which has reached a level over 107, its highest level since October 2002. Following the presentation of the FOMC minutes, the US Treasury yields started to rise again.

Figure 1: The US 10-year bond yields and the USD index on the daily chart

The SP 500 Index

The temporary decline in US Treasury yields was the reason for the correction in the bearish trend in equity indices. However, the bear market still continues to be supported fundamentally by fears of an impending recession.

Figure 2: The SP 500 on H4 and D1 chart

The nearest resistance according to the H4 chart is in the 3,930 - 3,950 range. A support is at 3,740 - 3,750 and then 3,640 - 3,670.

German DAX index

The German manufacturing PMI for June came in at 52.0 (previous month 54.8). The downward trend shows a deterioration in optimism.

It is worth noting that Germany's trade balance is negative for the first time since May 1991, i.e. imports are higher than exports. The current trade balance is - EUR 1 billion. The market was expecting a surplus of 2.7 billion. Rising prices of imported energy and a reduction in exports to Russia have contributed to the negative balance.

Figure 3: German DAX index on H4 and daily chart

The DAX is in a downtrend. On the H4 chart, it has reached the moving average EMA 50. The resistance is in the range of 12,900 - 12,960. Strong support on the daily chart is 12,443 - 12,500, which was tested again last week.

Euro is near parity with the USD

Even high inflation, which is already at 8.6%, has not stopped the euro from falling. It seems that parity with the dollar could be reached very soon. The negative trade balance in Germany has contributed very significantly to the euro's decline.

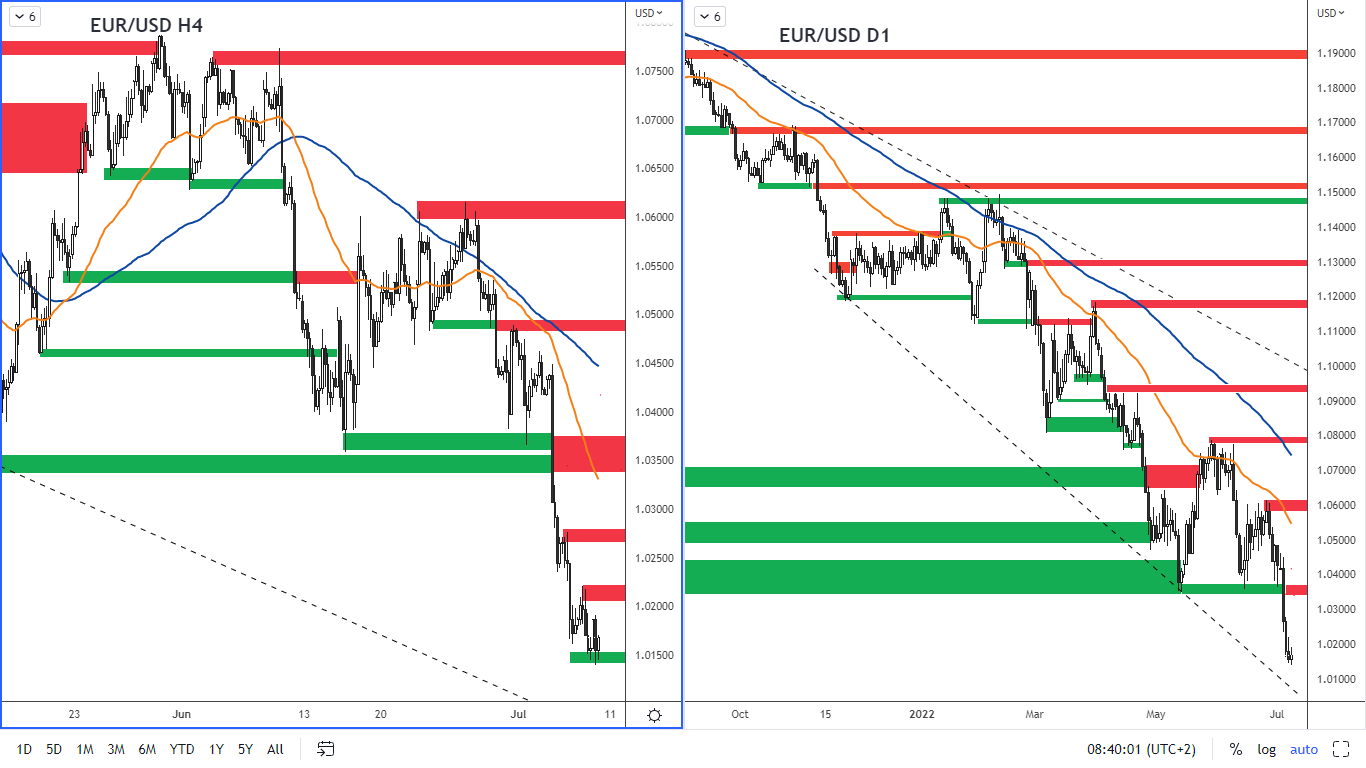

Figure 4: EUR/USD on H4 and daily chart

The nearest resistance according to the H4 chart is at 1.020 - 1.021. Support according to the daily chart would be only at parity with the dollar at 1.00. Reaching this value would represent a unique situation that has not occurred on the EUR/USD pair since 2002.

Australia raised interest rates

The Reserve Bank of Australia raised the interest rate by 0.50% as expected. The current interest rate now stands at 1.35%. According to the central bank, the Australian economy has been solid so far thanks to commodity exports, the prices of which have been rising. Unemployment is 3.9%, the lowest level in 50 years.

One uncertainty is the behaviour of consumers, who are cutting back on spending in times of high inflation. A significant risk is global development, which is influenced by the war in Ukraine and its impact on energy and agricultural commodity prices.

Figure 5: The AUD/USD on H4 and daily chart

The AUD/USD is in a downtrend and even the rate hike did not help the Australian dollar to strengthen. However, there has been some correction in the downtrend.

The resistance according to the H4 chart is 0.6880 - 0.6900. The support is at 0.6760 - 0.6770.