Stock #1: META - is the current growth exaggerated?

Since the beginning of the year, Meta's stock is up 40%, clearly beating the market. Investors were pleased with the Q4 results last year and Mark Zuckerberg's words that 2023 will be a year of efficiency and significant change. Let's take a look at exactly what Meta reported and why investors should still be cautious.

What went well:

- Revenue came in at $32.17 billion, beating market expectations.

- The number of daily active users also exceeded market expectations, reaching 2 billion.

- Capital expenditure is expected to come down to USD 30-33 billion this year, from USD 34-37 billion that was expected.

- Meta bought back USD 28 billion of its own shares last year. It has now agreed to another USD 40 billion in new buybacks.

What went wrong:

- While sales were better than expected, they fell 4% year-on-year. In addition, this is the 3rd consecutive quarter of year-on-year sales declines.

- For Q1, Meta expects sales of $26 billion to $28.5 billion. A year earlier, sales were USD 27.9 billion. So we may be in for another year-over-year decline.

- Q4 earnings fell 55% year-over-year to $4.65 billion.

- The number of monthly active users came in at 2.96 billion, the market was expecting 2.98 billion.

- Meta grew by 86,000 employees last year, about 20% of its total workforce. About 11,000 of them were laid off by the company in November, and more layoffs are likely to follow. Exceeded company growth will cost Meta more in severance costs.

- Reality Labs, under which Meta develops Metaverse, posted a loss of nearly $14 billion last year.

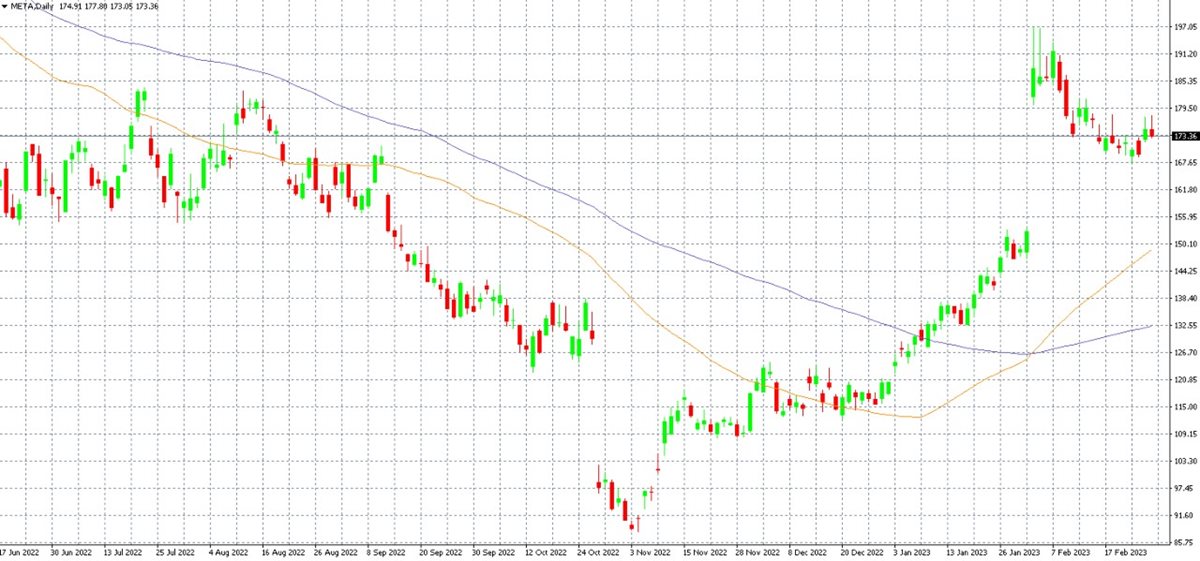

Shares of Meta Platforms in the MT4 platform on the D1 timeframe along with the 50 and 100-day moving averages

From the text above it is clear that both bears and bulls found their own on the Meta results. The latter clearly won, with Meta shares up more than 20% after the results, as can be seen in the gap chart above. However, after such a meteoric rise, made at the beginning of the year, a great deal of caution is in order.

Indeed, question marks hang over the ability of individual apps to grow. Thanks to Apple's new privacy settings, for the first time ever, Meta's ad revenue did not increase year-over-year. In addition, TikTok, which is beginning to steal more and more market share, is a significant competitor. The other big unknown is Metaverse, which is proving to be a huge misstep. In this time of cost-cutting, there is not much room for investment in expensive VR equipment among consumers, and the same goes for Metaverse advertisers.

According to Mark Zuckerberg, this year should be the year of efficiency, so the company should save costs. Lower investment in Metaverse would definitely help, but Mark Zuckerberg doesn't want to give that up. The results for the next quarter will tell us more about Meta's future - but it is quite possible that the stock growth from the beginning of the year will prove to be exaggerated. So we expect a lot of volatility in Meta stock going forward. The wishful thinking of all shareholders may be a ban on TikTok in the US, which has long been discussed. However, its reality is still unlikely.