Optimistic forecasts put the dollar under pressure

The US dollar lost 2% in April and was saved from a larger weakening by Friday's session during which the dollar strengthened significantly. Currently, the dollar is mainly helped by the positive outlook for economic growth and the lower need to keep the US dollar safe. It could thus strengthen further, at least until the numbers of rapid inflation rise are available.

Stable yields

U.S. government bond yields are still stagnating below levels that have made the dollar more attractive, which, along with better economic data, is putting the dollar under pressure. However, the yield on ten-year maturities oscillates around 1.65% and their increase over the past week also helped Friday's profits. Higher demand for bonds, and thus also for the US dollar, could come if yields reached above 1.75%. This could be helped by inflation, which increased in March.

Further developments depend on economic data

At this point, the US dollar is counting up the losses it has accumulated in recent weeks. It was helped mainly by better macroeconomic data and the repeated reassurance from the Fed stating that the central bank really does not plan to loosen monetary policy. The weaker dollar highlighted the gains in currencies that had been under strong pressure until then. For example, the Brazilian real was the best performing currency of the month. Also, along with negative data on the development of the European economy, we can expect that the gradual easing of restrictions will lead to better economic outcomes and investors will sell the US dollar.

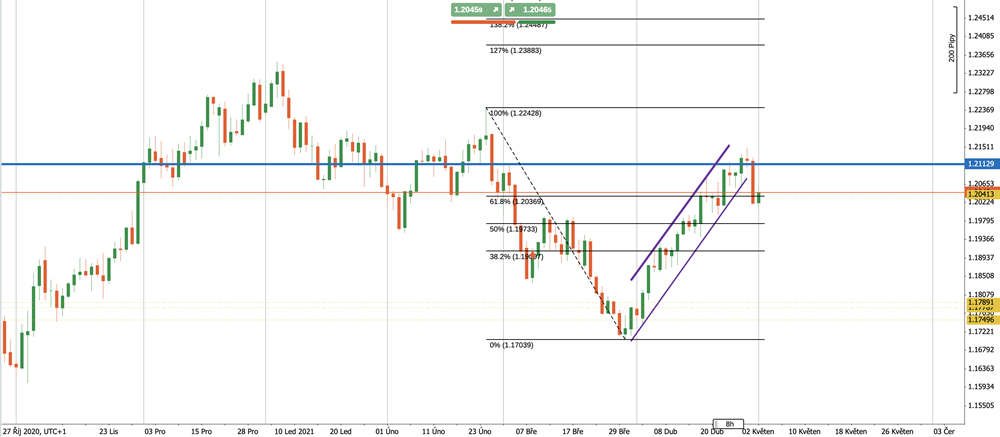

EURUSD may weaken

Faster economic expansion is also confirmed by the growth of industrial and agricultural commodities. The so-called supercycle in commodity markets was predicted by a number of analysts at the beginning of the year, which is confirmed by the currently growing demand with a faster recovery in the labor market. However, on some currency pairs, there is no such room for another long-term weakening of the US dollar. For example, in the eurozone, the monetary stimulus will need to be maintained for a much longer period of time which will postpone the arrival of economic growth, which may open the gap between the US and the euro area and put the euro under pressure.

Chart: EURUSD Daily Chart (source: cTrader Purple Trading)