The Swing Overview - Week 11

The fall in the indices that we have seen in recent days has stopped. The indices strengthened on expectations of a diplomatic solution to the war in Ukraine, which has been going on for more than three weeks. However, these negotiations have not led to any significant breakthrough yet, so the upside potential for the indices could be limited.

In addition, the Fed has started its own war against inflation and raised interest rates for the first time in three years, which is rather negative news for equity indices in the short term. However, the statistics say that in the long run it does not mean a trend reversal for the SP 500 index. The Bank of England also raised rates, but the pound surprisingly weakened. The reason for this is in our article.

The war in Ukraine

The war in Ukraine has been going on for more than three weeks now and there is still no end in sight. Sentiment has started to improve after reports on negotiations for a diplomatic solution to the war. However, Russia continues to make unrealistic demands that Ukraine cannot agree to. Negotiations have therefore have not led to a solution yet.

Meanwhile, the economic situation in Russia continues to deteriorate rapidly as a result of the sanctions. The credit rating agency Standard & Poor's has downgraded Russia's credit rating from the current grade CCC- to CC. Russia has already announced that it is having difficulty repaying its bonds. However, Russia managed to pay the coupon payments that were due this week, averting the country's imminent bankruptcy for now.

The war in Ukraine will have a negative impact on the global economy. World economic growth for 2022 is expected to fall from 4% to 3.2%. Apart from Russia and Ukraine, Europe and the UK will be hardest hit, where there is a significant risk of recession.

The Fed has raised interest rates

The US Fed has launched a war on inflation and raised interest rates for the first time since December 2018. The current rate is 0.50% and further increases will continue. The Fed disclosed that rates are expected to rise to 2.80% within a year.

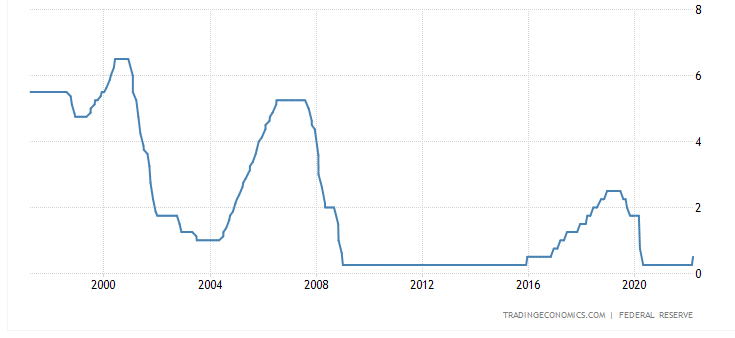

Figure 1: The evolution of interest rates in the US

The evolution of interest rates, over the last 25 years, is shown in Figure 1.

Jerome Powell commented that the Fed's main goal is to achieve price stability and maximum employment. He expects inflation, which has now reached 7.9%, to reach the target of 2%, but this will take longer than originally expected.

The problem is a persistent labour shortage, which is putting upward pressure on wages. However, the situation is already starting to normalise in some sectors, suggesting that this should not be an uncontrollable spiral wage growth that would strongly support inflation.

According to Powell, the US economy is in good shape and ready for monetary policy normalisation. Therefore, the Fed will start in May to reduce the bonds in its balance sheet, which has grown considerably to almost $9 trillion thanks to the support of the economy during the covid pandemic.

The Index SP500

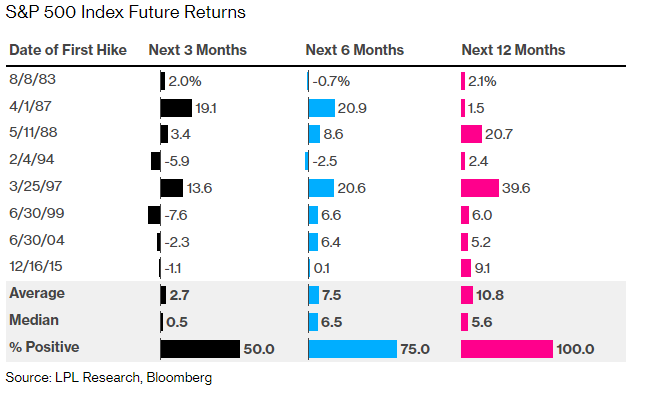

As far as the impact of interest rate hikes is concerned, this should not change the long-term bullish market. Statistics confirm that over the following 12 months from the date of the hike, the index has reached higher levels in every case since 1983.

Figure 2: The impact of the first interest rate hike on the performance of the SP 500 index. Source: Bloomberg

Figure 2: The impact of the first interest rate hike on the performance of the SP 500 index. Source: Bloomberg

However, the statistics also show that in the short term, there were declines in the index within 3 months and this cannot be ruled out now as well.

As for the current developments on the SP 500 index, it has recently bounced off its supports. The reason for this was the hope for a diplomatic solution to the war in Ukraine. However, this has stalled. The Fed also gave optimism to the indices with its statement about the economy doing well.

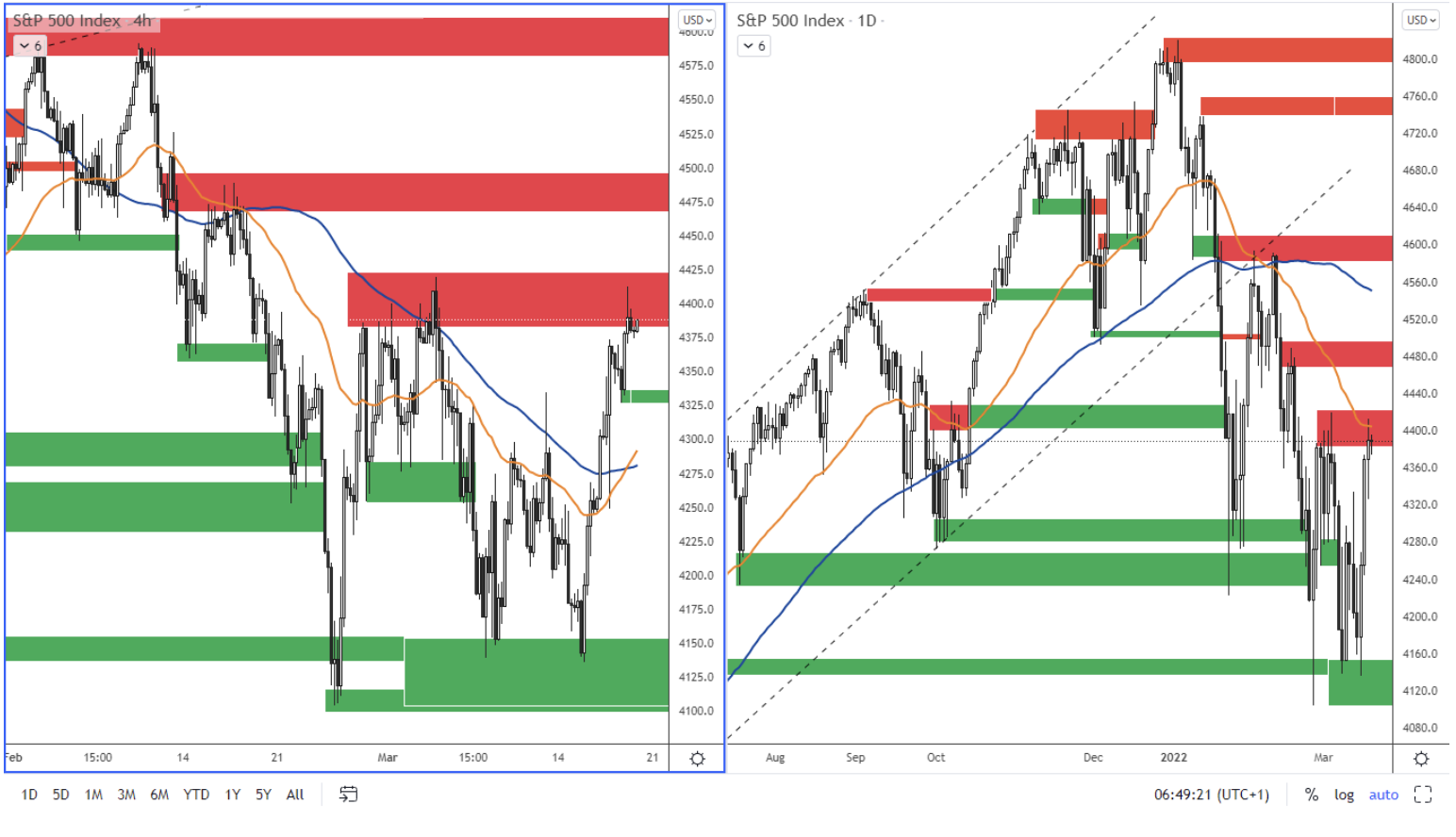

Figure 3: SP 500 on H4 and D1 chart

Figure 3: SP 500 on H4 and D1 chart

Overall, the index is currently in a downtrend. In terms of technical analysis, the price has reached the resistance level which is at 4,383 - 4,420. According to the daily chart, the price has reached the EMA 50 moving average, which also serves as resistance. Support according to the H4 chart is at 4,328 - 4,334. Significant support according to the daily chart is at 4 105 - 4 152.

German DAX index

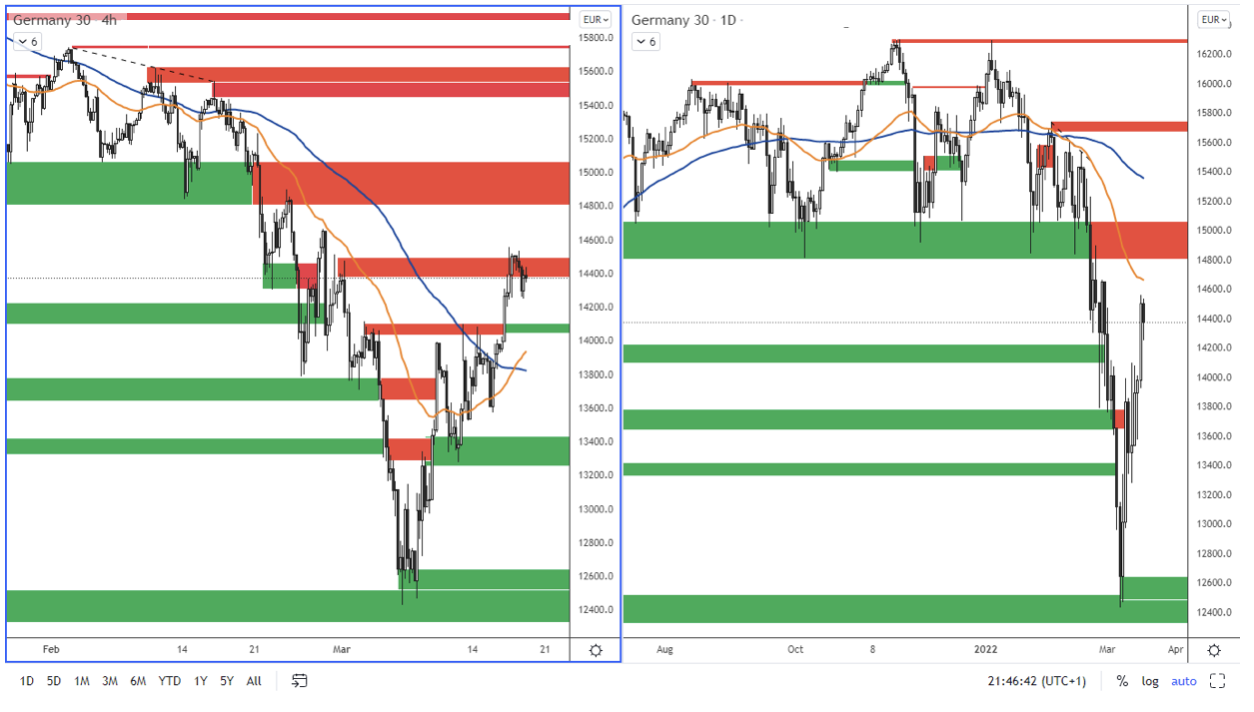

Figure 4: The German DAX index on H4 and daily chart

Figure 4: The German DAX index on H4 and daily chart

There was a significant deterioration in economic sentiment in Germany in March, as shown by the ZEW index, which reached a negative reading of -39.3. However, the DAX index, which is much more affected by the war in Ukraine than the US indices, strengthened last week. The reason for the index's rise was mainly due to signs of a diplomatic solution to the conflict.

The price climbed up to the resistance level on the H4 chart last week, which is in the area near the 14,500 price. The strong resistance according to the daily chart is in the range between 14,800 - 15,000. The closest support according to the H4 chart is at 14,030 - 14,100.

The euro strengthened after the Fed announcement

The euro price retested the resistance area which is in the area near 1.1130 - 1.1150 according to the daily chart. However, the Euro remains under pressure and although the ECB was surprisingly hawkish at the last meeting, it is still lagging behind compared to the US Fed. Moreover, the war in Ukraine, and according to some, the looming recession in the Eurozone, does not give much room for the Euro to strengthen.

Therefore, it would not be surprising if the EURUSD falls to levels around 1. 0890 - 1. 0900, where the nearest support level is.

Figure 5: The EURUSD on the H4 and daily charts.

Figure 5: The EURUSD on the H4 and daily charts.

From a technical point of view, we can see that EURUSD is still in a downtrend according to the daily chart, so the current pullback may be an opportunity for trades in the short direction.

The Bank of England also raised interest rates

The Bank of England raised its key interest rate by 0.25%. Therefore, the rate is currently at 0.75%. By raising interest rates, the central bank is responding to rising inflation, which is expected to hit 8% in June 2022.

But the pound surprisingly weakened sharply after the rate announcement. This was because the central bank was much more cautious in its expectations for the future of the economy. There are already signs that the war in Ukraine is having a negative impact on consumer confidence and is also having a negative impact on household incomes. This would slow economic activity. That is why the central bank has moved away from its previous aggressive hawkish tone.

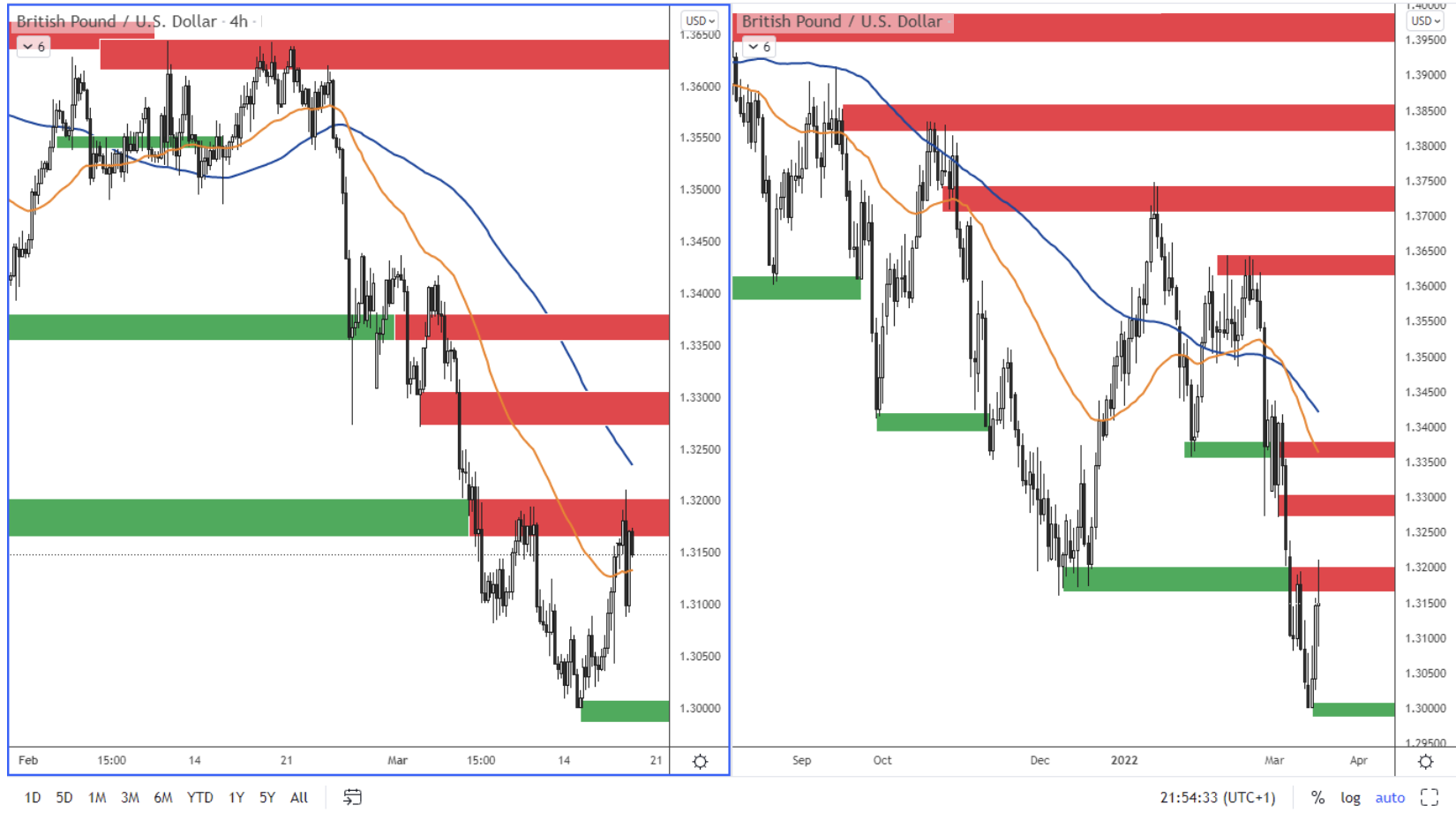

Figure 6: The British Pound on H4 and daily chart.

Figure 6: The British Pound on H4 and daily chart.

A resistance is in the area of 1.3170 - 1.3200, where the price has halted. A support is at 1.3000.