Palantir - the bet on the future is not working out yet

Since the beginning of the year, Palantir has also been doing well, with its shares appreciating by almost a third. Palantir is in the data analytics business and also provides its services to the US government. It has long been talked about as a revolutionary company and a clear bet on the future. However, this bet hasn't worked out too well so far, exactly 2 years ago Palantir shares were worth over $30, today they are worth around $8. However, we are still waiting for last quarter's financial results, which should be released on February 13. Thus, the growth of the shares from January is more related to the return of risk-on sentiment to the stock markets. But what can we expect from Palantir in the coming weeks?

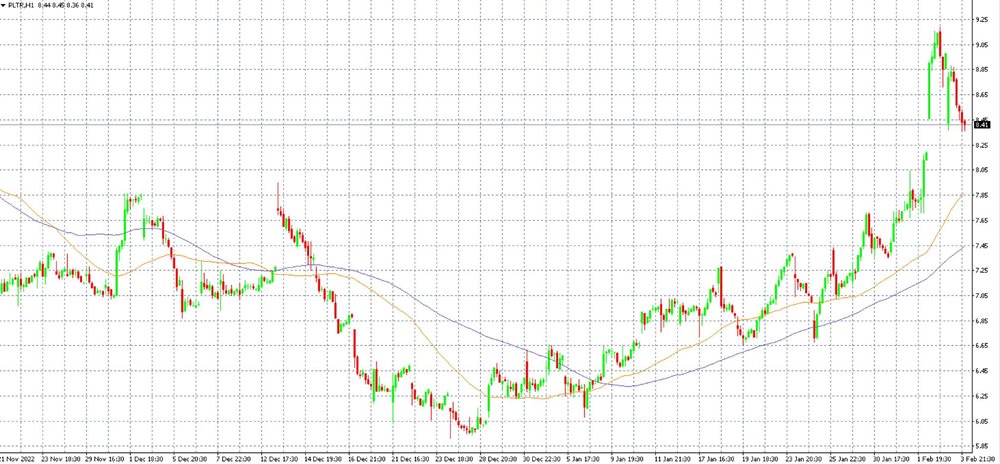

Shares of Palantir in the MT4 platform on the H1 timeframe along with the 50 and 100 day moving averages

Q4 revenue is expected to grow by 16% year-on-year to EUR 502.6 million. Earnings per share should be USD 0.03 (up 1 cent). So these are not miraculous numbers, what will be important is the outlook for this year. In particular, the expectations for commercial revenues will be key, as these have long lagged behind those of the government. Palantir has around 60% of its revenues from the latter. The company is looking to expand into the healthcare and energy sectors, but a possible recession could derail these plans.

So all the expected risks may not be priced into the stock, especially after the massive run-up in January. Thus, there are certainly plenty of waves on the horizon that could send Palantir in either direction. Thus, it will depend on earnings and the overall mood of the stock markets. If the risk-on sentiment is maintained, Palantir stock can strengthen further. However, the opposite scenario seems more likely for now.